The United States is perilously near to falling into a recession, regardless of the reassurances of Federal Reserve officers, Wall Road economists and economic journalists. That is not just an idle opinion it’s what the info say.

Let us let the figures speak for on their own.

‘A deep, common, and lasting downturn’

Opposite to what you’ve listened to, a economic downturn — at least in the U.S. — is not outlined by two straight quarters of slipping gross domestic solution. It’s additional nuanced than that.

According to the Countrywide Bureau of Economic Analysis, a private body which is commonly accepted as the official historian of U.S. small business cycles, “a recession consists of a major decrease in economic exercise that is unfold throughout the financial state and lasts much more than a couple of months.” The important components are depth, diffusion and period.

The decline in GDP in the 1st quarter would not satisfy the criteria, due to the fact the weak point was not prevalent it was confined to 1 element of the overall economy — the trade deficit — while the relaxation of the financial system grew at a nutritious amount. In truth, imports ended up superior specifically since domestic need was robust.

Also read: A ‘fake’ economic downturn? The U.S. financial state is in decent condition for now even with weak GDP

And an anticipated drop in the just-concluded second quarter — we’ll obtain out up coming 7 days when the data are launched — may well not meet up with the diffusion standards, both, because most of the obvious weak point was in residence setting up and inventory expansion, not in buyer paying out or organization output.

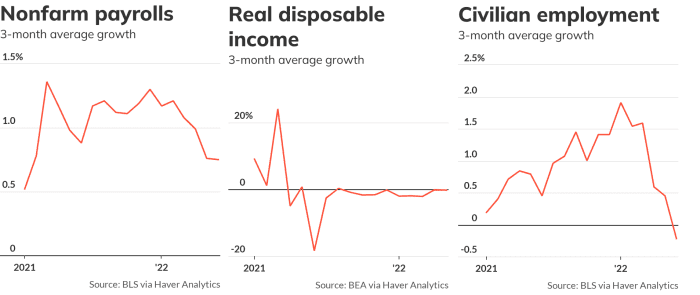

In observe, the NBER seems mostly at six monthly coincident indicators to judge regardless of whether the financial system is increasing or contracting, regardless of whether a slump meets the examination of depth, diffusion and period.

“ The U.S. has by no means endured a economic downturn with no a significant drop in work opportunities and a concurrent rise in unemployment. But Japan has. ”

The most critical quantity is the progress of nonfarm payrolls, gathered in a survey of enterprises. Not only is employment inherently the most crucial gauge of the wellbeing of economy, but the payroll study is viewed as to be the most statistically trustworthy of all the coincident indicators.

Other variables are also viewed as, this kind of as progress of true personal incomes, industrial output and actual sales by corporations. (“Real” usually means modified for inflation.)

These four indicators — payrolls, incomes, output and profits — compose the index of coincident indicators, which is launched by the private Convention Board each individual thirty day period. The coincident index rose .2% in June, the team reported Thursday.

The NBER also appears to be like at a every month estimate of GDP, and an alternate check out of civilian work obtained from a study of homes. It also requires quarterly gross domestic product and gross domestic cash flow into account. NBER does not use the unemployment amount, simply because it’s truly a lagging indicator.

The coincident indicators

MarketWatch

Four of these 6 coincident indicators — serious disposable incomes, actual gross sales, civilian employment and every month GDP — have declined in excess of the past 3 months. (Caveat: I’m applying a slightly unique measure of incomes than the NBER has ordinarily made use of, mainly because the standard evaluate is sending a misleading signal proper now. But incomes are slowing pretty a bit by either measure.)

A fifth indicator — industrial output of factories, mines and utilities — has been slowing and in fact fell in the most current thirty day period.

Of the six indicators, only nonfarm payrolls have ongoing to develop at a good price. Is that adequate to give us confidence that the overall economy is not in a economic downturn? Commonly, the reply would be “yes.” Which is why Fed Gov. Christopher Waller was so selected when he stated not long ago that “it would be tricky to say we have a recession with 3.6% unemployment.”

The U.S. has never ever endured a economic downturn without the need of a considerable drop in employment and a concurrent increase in unemployment. But Japan has.

In Japan, the economic climate can slip into economic downturn with out expanding unemployment due to the fact Japanese firms tend to keep staff members even when their profits drops sharply. Japan is an growing old modern society, and staff are so scarce that firms will hold them on the payroll (at reduced shell out and hours) by means of a slump until eventually the overall economy recovers.

That appears a good deal like the present dynamic in the U.S. overall economy, with corporations going through a lack of able and ready staff. (And it is getting a structural difficulty for the U.S., as it is for Japan.) It is achievable that the U.S. overall economy will start off behaving a lot more like Japan’s now that its demographics glimpse additional like Japan’s.

Universally bleak

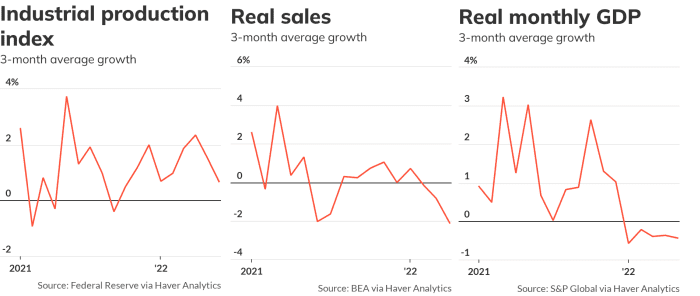

Aside from these 6 indicators that convey to us how the economic system is faring now, economists have discovered other economic information that hint at what the economy will search like in the close to long run. These so-known as main indicators are universally bleak.

On Thursday, the Convention Board stated that “U.S. economic downturn all over the conclusion of this yr and early future is now likely” after it reported that the index of main indicators fell .8% in June.

MarketWatch

The granddaddy of main indicators is the generate curve, which is determined by the distribute between the yield on the 2-yr Treasury note

TMUBMUSD02Y,

and that on the 10-yr be aware

TMUBMUSD10Y,

An inverted (or adverse) yield curve is the finest solitary predictor of an forthcoming economic downturn, and it recently turned detrimental. Possibly it’ll continue to be inverted maybe it won’t.

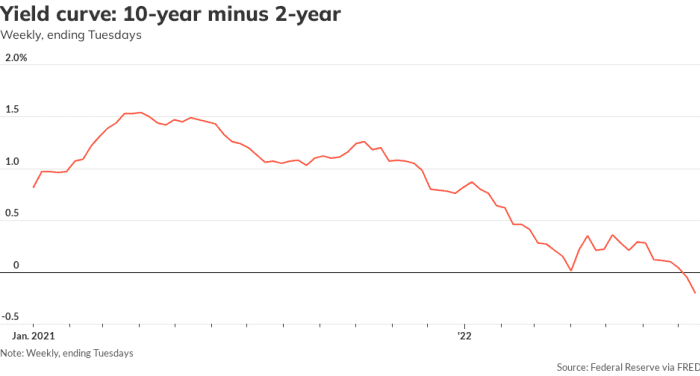

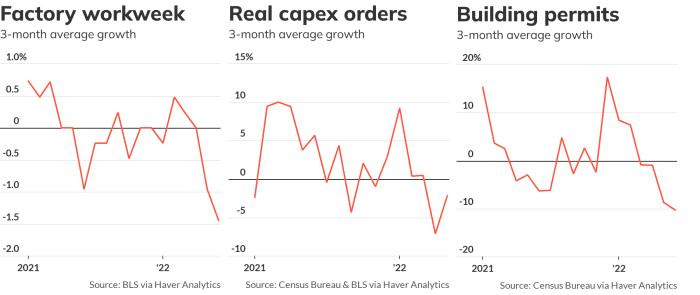

The other main indicators

MarketWatch

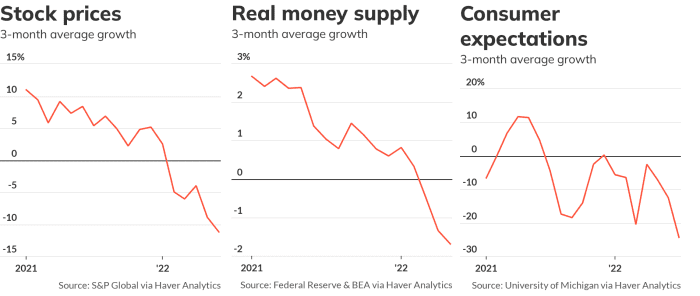

The other major main indicators were being previously adverse. The dollars offer is slipping now that the Fed is tightening up on credit history and shrinking its equilibrium sheet.

Constructing permits — which level to foreseeable future development — are collapsing as the Fed pushes up fascination fees and will make homes even more unaffordable. Consumer expectations have sunk as inflation batters household budgets.

Enterprises are shedding self confidence, as effectively. With shoppers retrenching, firms have slice back on investments in money merchandise, and factories are cutting workers’ hrs. Inventory rates

SPX,

DJIA,

COMP,

have experienced in line with decreased envisioned gains, bigger interest prices and heightened uncertainty.

The risk is significant

I really don’t have a crystal ball. I really do not forecast the economic system. I don’t know if the U.S. is fated to tumble into a economic downturn, or if it is by now in just one. Potentially the bulls are right that inflation will average just more than enough to give shoppers and corporations self-confidence and revenue to preserve the growth going.

But I do fear that plan makers, economists, buyers and journalists might be far too nonchalant about the danger of a economic downturn this year. The knowledge suggest that the risk is significant and rising.

Rex Nutting has been producing about economics for MarketWatch for a lot more than 25 a long time.

Also from Rex Nutting

The actual labor lack is looming, and anything we’re undertaking is building it worse

The Federal Reserve can not even get the course of the economic system proper

There is a big gap in the Fed’s concept of inflation—incomes are falling

Why curiosity fees aren’t really the appropriate resource to management inflation

More Stories

How to Use Leverage in Bonds CFD Trading Effectively

The E-commerce Business Boom: What You Need to Know

Pros and Cons of Starting a Dropshipping Business