Lantheus Holdings (LNTH) is 1 of the shares most viewed by Zacks.com site visitors lately. So, it could possibly be a very good concept to evaluate some of the aspects that may well impact the around-phrase overall performance of the stock.

Above the past thirty day period, shares of this diagnostic imaging organization have returned +14.8%, in contrast to the Zacks S&P 500 composite’s +12% improve. Through this period, the Zacks Healthcare – Products and solutions field, which Lantheus Holdings falls in, has dropped 17.4%. The important concern now is: What could be the stock’s long term direction?

When media releases or rumors about a sizeable improve in a firm’s enterprise prospective clients ordinarily make its stock ‘trending’ and lead to an quick selling price change, there are usually some elementary details that ultimately dominate the purchase-and-maintain conclusion-building.

Earnings Estimate Revisions

In this article at Zacks, we prioritize appraising the transform in the projection of a firm’s long term earnings over just about anything else. That’s due to the fact we believe that the present price of its upcoming stream of earnings is what decides the good value for its inventory.

We primarily glimpse at how provide-side analysts covering the inventory are revising their earnings estimates to mirror the impression of the hottest organization tendencies. And if earnings estimates go up for a enterprise, the honest worth for its inventory goes up. A better reasonable worth than the recent market place value drives investors’ desire in getting the inventory, major to its price tag going larger. This is why empirical exploration reveals a robust correlation amongst developments in earnings estimate revisions and close to-phrase inventory selling price actions.

For the current quarter, Lantheus Holdings is envisioned to publish earnings of $.69 per share, indicating a improve of +762.5% from the yr-ago quarter. The Zacks Consensus Estimate remained unchanged in excess of the final 30 days.

For the present fiscal calendar year, the consensus earnings estimate of $3.08 details to a modify of +528.6% from the prior calendar year. In excess of the last 30 times, this estimate has remained unchanged.

For the upcoming fiscal 12 months, the consensus earnings estimate of $3.62 signifies a adjust of +17.5% from what Lantheus Holdings is predicted to report a 12 months back. Above the past month, the estimate has remained unchanged.

With an spectacular externally audited monitor record, our proprietary inventory rating device — the Zacks Rank — is a additional conclusive indicator of a stock’s close to-time period selling price general performance, as it successfully harnesses the ability of earnings estimate revisions. The size of the current change in the consensus estimate, alongside with 3 other things connected to earnings estimates, has resulted in a Zacks Rank #1 (Strong Get) for Lantheus Holdings.

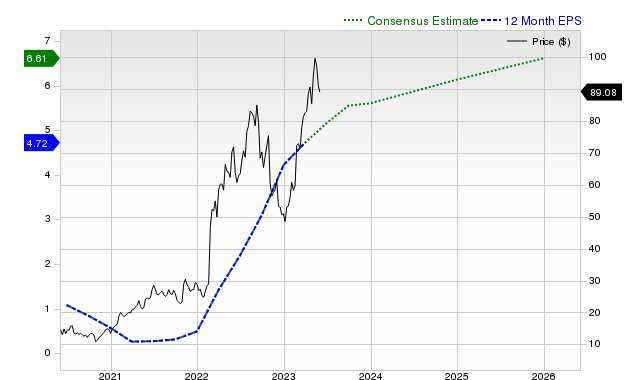

The chart beneath shows the evolution of the firm’s ahead 12-thirty day period consensus EPS estimate:

12 Month EPS

Income Expansion Forecast

When earnings expansion is arguably the most exceptional indicator of a company’s economical well being, almost nothing comes about as this kind of if a enterprise is not able to expand its revenues. Just after all, it truly is approximately difficult for a firm to improve its earnings for an extended period devoid of expanding its revenues. So, it’s crucial to know a company’s opportunity revenue growth.

For Lantheus Holdings, the consensus sales estimate for the latest quarter of $229.55 million indicates a calendar year-more than-calendar year change of +124.9%. For the present and future fiscal decades, $900.67 million and $995.56 million estimates indicate +111.8% and +10.5% alterations, respectively.

Very last Noted Benefits and Shock Background

Lantheus Holdings documented revenues of $223.72 million in the past reported quarter, symbolizing a 12 months-over-yr change of +121.4%. EPS of $.89 for the exact time period compares with $.11 a 12 months in the past.

Compared to the Zacks Consensus Estimate of $203.98 million, the documented revenues depict a surprise of +9.68%. The EPS shock was +27.14%.

The firm beat consensus EPS estimates in every of the trailing 4 quarters. The enterprise topped consensus income estimates each individual time about this period of time.

Valuation

Without having considering a stock’s valuation, no financial commitment conclusion can be economical. In predicting a stock’s potential price tag performance, it is really very important to decide irrespective of whether its present-day price the right way demonstrates the intrinsic worth of the underlying business and the firm’s expansion potential clients.

Whilst evaluating the present values of a firm’s valuation multiples, these types of as price-to-earnings (P/E), value-to-gross sales (P/S) and price-to-hard cash stream (P/CF), with its very own historical values allows establish no matter whether its inventory is reasonably valued, overvalued, or undervalued, evaluating the firm relative to its peers on these parameters provides a good sense of the reasonability of the stock’s value.

As component of the Zacks Style Scores technique, the Zacks Price Design Rating (which evaluates both of those classic and unconventional valuation metrics) organizes stocks into five teams ranging from A to F (A is better than B B is much better than C and so on), making it helpful in determining whether a stock is overvalued, rightly valued, or briefly undervalued.

Lantheus Holdings is graded F on this front, indicating that it is trading at a high quality to its peers. Click on in this article to see the values of some of the valuation metrics that have pushed this grade.

Base Line

The information mentioned below and substantially other information and facts on Zacks.com may possibly enable establish no matter whether or not it really is worthwhile paying interest to the industry excitement about Lantheus Holdings. Nonetheless, its Zacks Rank #1 does advise that it could outperform the broader market in the in the vicinity of expression.

Want the most current tips from Zacks Investment Research? These days, you can obtain 7 Greatest Stocks for the Next 30 Times. Click on to get this no cost report

Lantheus Holdings, Inc. (LNTH) : Free Stock Assessment Report

To read through this short article on Zacks.com click listed here.

Zacks Expenditure Research

More Stories

Business email hosting trends and the future of email hosting

Want to be more present? Try taking out your phone

The Detailed Job Description of a Retail Buyer