Catherine Wood (Trades, Portfolio) is the founder and chief expenditure officer at Ark Make investments. She believes innovation is the important to progress, and her growth strategy was wildly profitable in 2020 and the early months of 2021.

On the other hand, her assortment of energetic ETFs have obtained underperformance in the afterwards component of 2021 and 2022. A short while ago, Ark Make investments produced a assertion which exposed its most current Transparency ETF (CTRU) will near at the stop of July, just eight months soon after launching. This was the first at any time ETF closure by the fund and arrived immediately after Transparency Worldwide introduced they will stop calculating the Transparency Index, which focuses on ESG. Thus, Wood decided to near this ETF, and its board of trustees permitted the final decision, as mentioned in a latest submitting with the SEC. For present shareholders in the fund, a redemption can be asked for just before July 26, when it formally closes.

Whilst the the latest ETF closure was discussed as extra of a technical concern with the index it was tracking, it does beg the dilemma of no matter whether this is the commencing of the conclude for Ark Invest. Presented the butchering Arks ETFs have taken given that the expansion inventory sector started cooling down, several traders have been wondering if the organization would finally shut its doorways, signaling the close of hope for this unique sector of the industry to recuperate speedily.

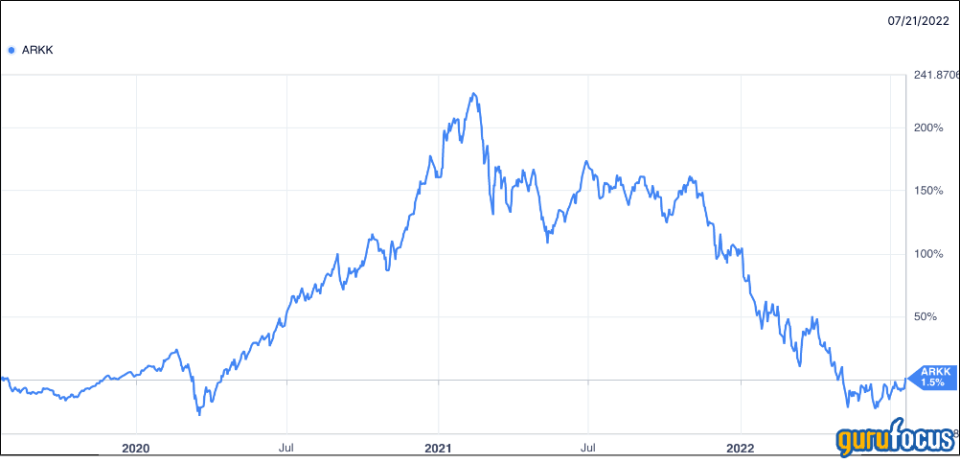

Arks flagship fund, the Ark Innovation ETF (ARKK), is down an eye-watering 69% from its highs in February 2021.

The a few premier holdings in ARKK are Zoom (8.41%), Roku (8.05%) and Tesla (8.02%). These are all shares which experienced important bull runs in 2020 but a declining share value due to the fact the fourth quarter of 2021.

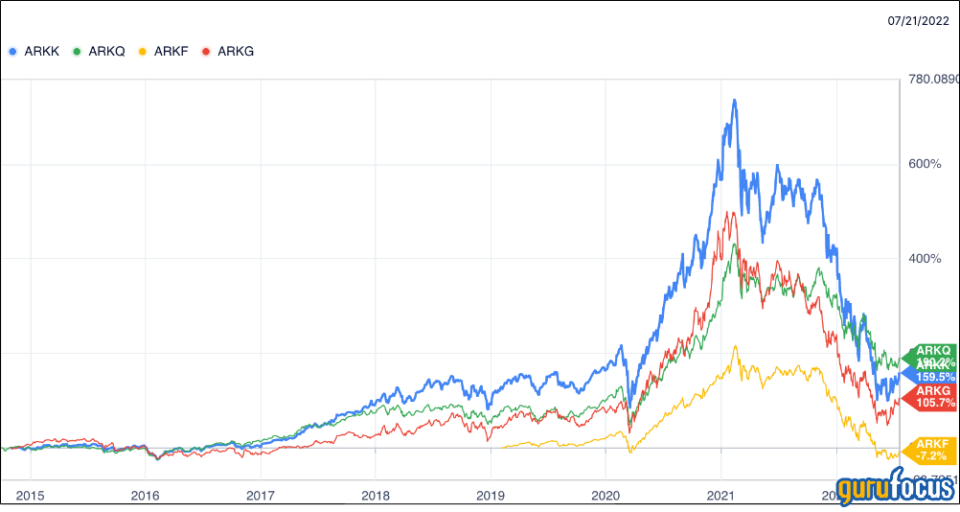

Ark Invest’s Fintech Innovation ETF (ARKF) has the top rated a few holdings of Block (SQ) (9.94%), Shopify(Store) (9.7%) and Coinbase (COIN) (8.38%). These are all stocks which have experienced their share cost decimated in excess of the past year. Ark’s other ETFs have all observed very poor performance due to the fact March 2021.

Ark Invest’s ETFs had a huge bull operate in 2020 and attained gains of more than 152%. This was driven by the low curiosity level environment and a heap of financial stimulus, which favors higher several advancement stocks this kind of as Tesla (TSLA), which was the greatest situation in lots of of Ark’s money, which include the flagship ARKK.

Having said that, when substantial inflation numbers began to show up in March 2021, and when the current market commenced to recognize that many “Covid shares” would see their pandemic boosts fall off soon, the fund saw billions of dollars in outflows as investors transitioned out of progress and into value.

Initially, this was observed as a buy the dip opportunity by quite a few traders. However, that dip retained dipping, and in the conclusion it was like attempting to capture a slipping knife as inflation and fascination fees have ongoing to increase.

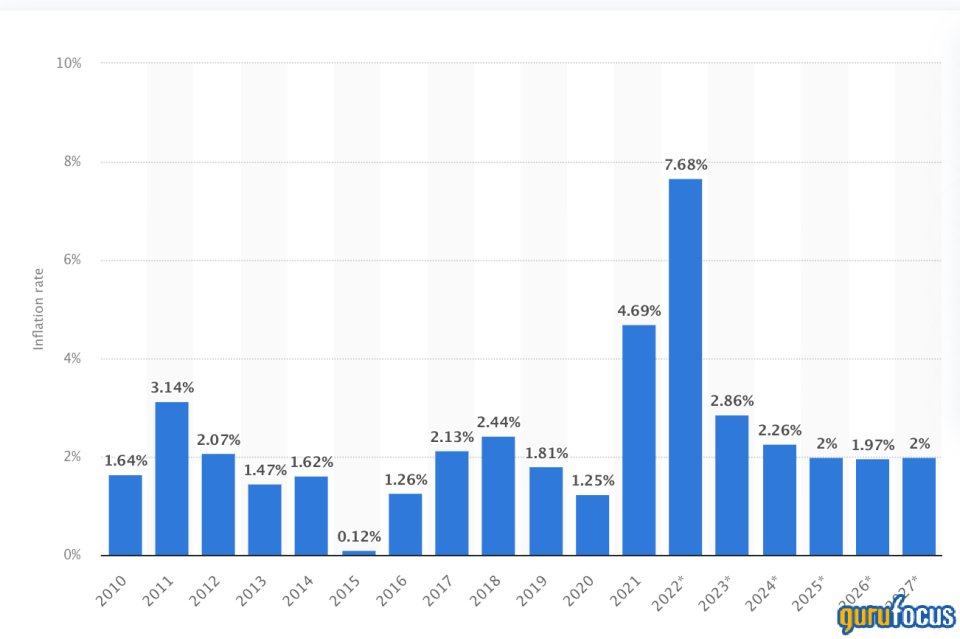

The fantastic information is, Statista forecasts inflation to dip again to much more workable levels of roughly 2.86% in 2023, then decline to 2% (which is the Fed’s focus on) in the several years following.

A adjust in the inflation setting is expected to favor Ark Make investments, and the fund even gained inflows of $658 million in Might, bringing the full to $1.5 billion for 2022. In addition, Wooden has reiterated they have a 5 12 months time horizon for all investments. ARKK has an annualized five-year return of 8.29%, and in all fairness, the results have been extremely skewed by the 2022 market bubble and subsequent collapse.

Arks ETFs have observed a raise in the earlier pair of months, and ARKKs share value is up by 31% from lows.

Wood’s weekly videos and social media updates also preserve retail traders engaged and assistance to increase inflows for the fund, or at least really encourage buyers to keep. In a prior interview, Wood mentioned her use of social media and classic media shops was a important key to Ark Invest’s early success.

When all is claimed, Ark Spend is a advancement stock investing business, and thus its investments are naturally going to mirror that. The present-day macroeconomic predicament has brought about tremendous underperformance in expansion stocks because March 2021. However, a lot more not too long ago, Ark’s funds have witnessed inflows and an uptick in share charges.

I dont consider this is the finish for Ark Spend any much more than it is the conclude for development shares. Nobody can doubt that investing into innovation is a solid thesis, and the moment the sector begins to convert in the direction of development all over again, I be expecting Ark Spend to get better as nicely.

This post to start with appeared on GuruFocus.

More Stories

Sarb hike: 50bps or 25bps?

Funds take record short position across U.S. Treasuries curve: McGeever

Philips buys Israeli co DiA Imaging Analysis