Summary: Filecoin is an interesting use case of blockchain technology, as it offers a decentralized storage network that competes with centralized alternatives like Amazon Web Services (AWS). In this article, we’ll look at how Filecoin makes money, and key metrics on its FIL token for investors.

What is Filecoin?

Filecoin, whose mainnet launched in 2020, is a decentralized data storage network and marketplace built on blockchain. It enables users to sell their excess data storage in exchange for FIL, the native token, which is a top 50 digital asset, with a market cap of over $1.5 billion as of this writing.

Filecoin acts as a decentralized incentive layer for the InterPlanetary File System (IPFS), a peer-to-peer (P2P) network for storing and sharing files in a distributed system. Unlike centralized servers and IP addresses, IPFS relies on hash-addresses content structures to store data. It is meant to boost efficiency and better secure data storage.

Filecoin incentivizes IPFS users by rewarding FIL tokens to those who provide storage or retrieve files, and thus contribute to the ecosystem. In other words, rent out your unused hard drive space to Filecoin, and earn FIL tokens.

Both Filecoin and IPFS were developed by Protocol Labs, a development company led by Stanford-trained computer scientist Juan Benet. The team has managed to attract investors for several seed equity rounds. In 2017, when the ICO (initial coin offering) craze was at its peak, Filecoin raised over $200 million from accredited US investors in one of the largest ICOs at the time.

Filecoin can also integrate with Ethereum, enabling developers to access data on Ethereum and interact with its smart contracts.

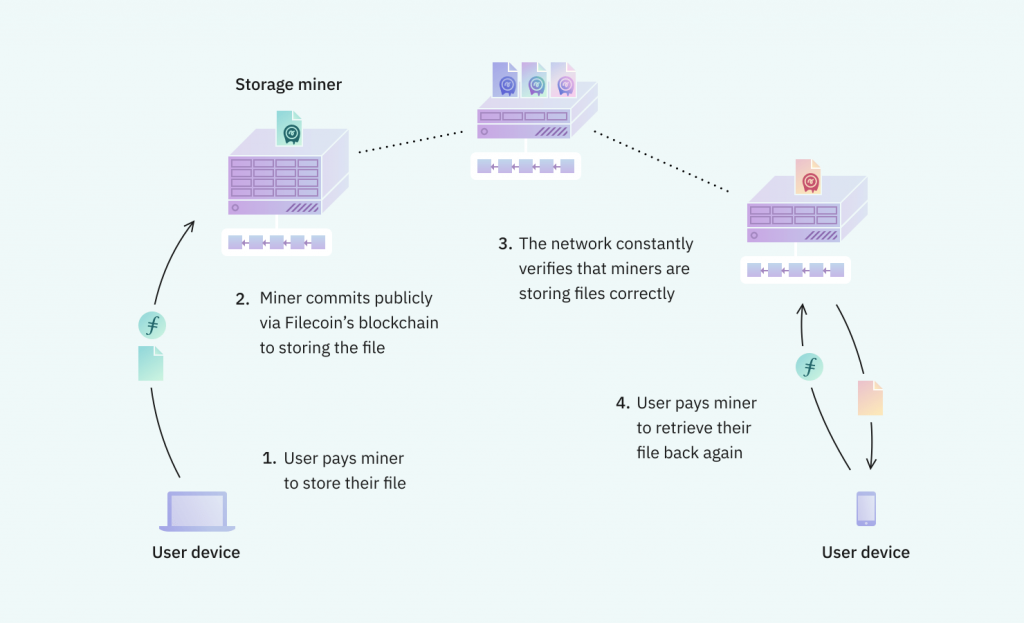

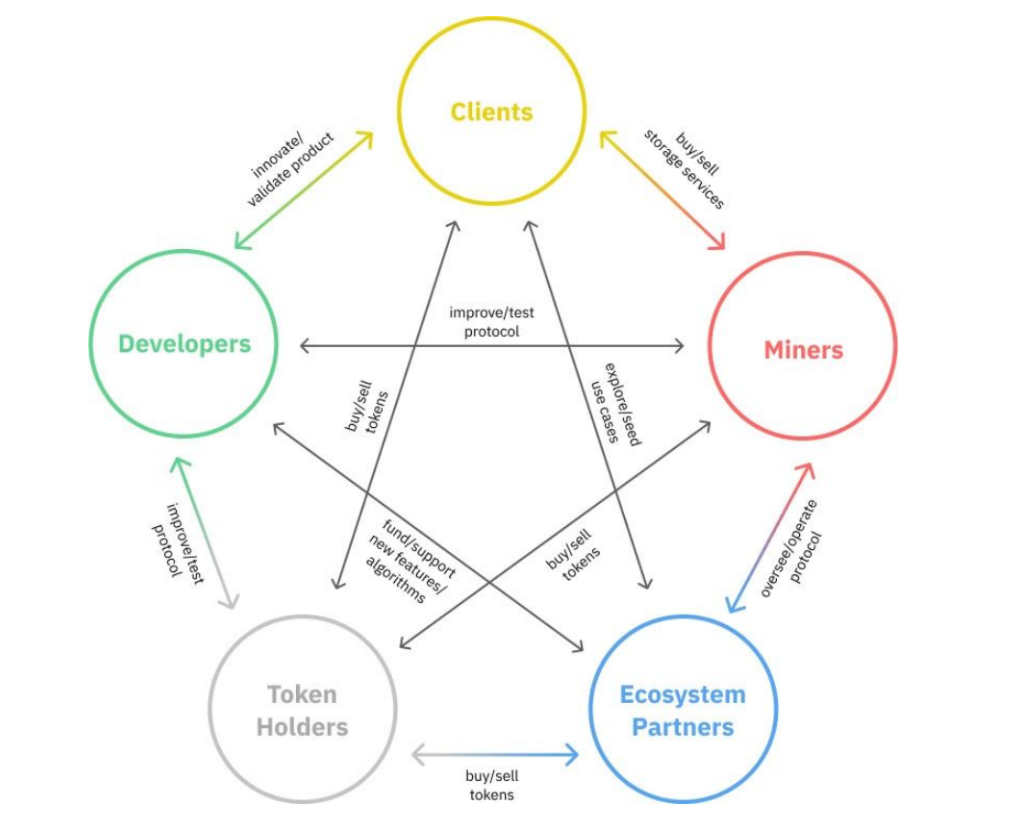

Filecoin’s decentralized storage network (DSN) processes storage and retrieval requests through two open markets: the Storage Market and the Retrieval Market. The former allows users to pay storage miners for storing their files while the latter enables users to pay retrieval miners to deliver the data. Both markets rely on order matching and order settlement functions.

In summary, the Filecoin network is used by both storage users (the demand side) and storage providers (the supply side). Both groups generate revenue through a fee system that is similar to Ethereum’s gas fees, with the Filecoin protocol burning network fees to compensate for the resources used.

At Bitcoin Market Journal, we analyze blockchains like businesses. So let’s see how Filecoin’s “business” has performed in terms of revenue.

How Filecoin Generates Revenue

The demand for storage on Filecoin has increased rapidly. Since the start of 2022, demand for storage has increased six times faster than the growth in storage capacity, according to data from Messari.

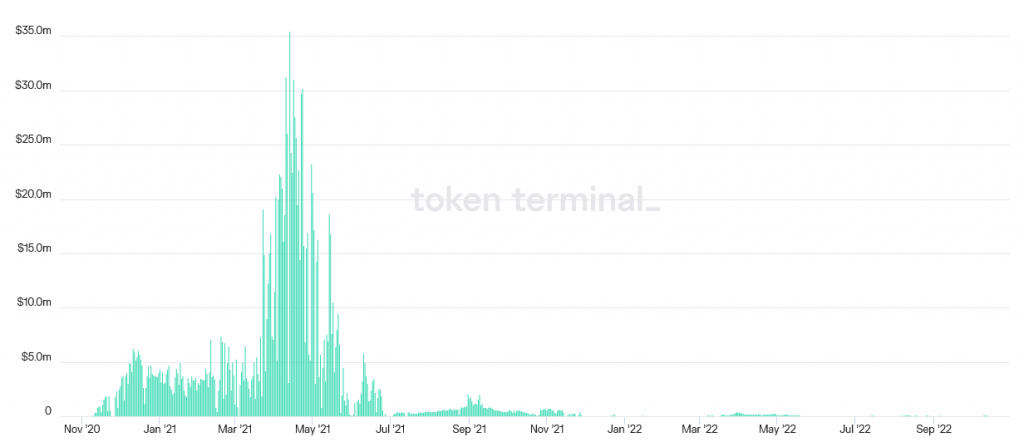

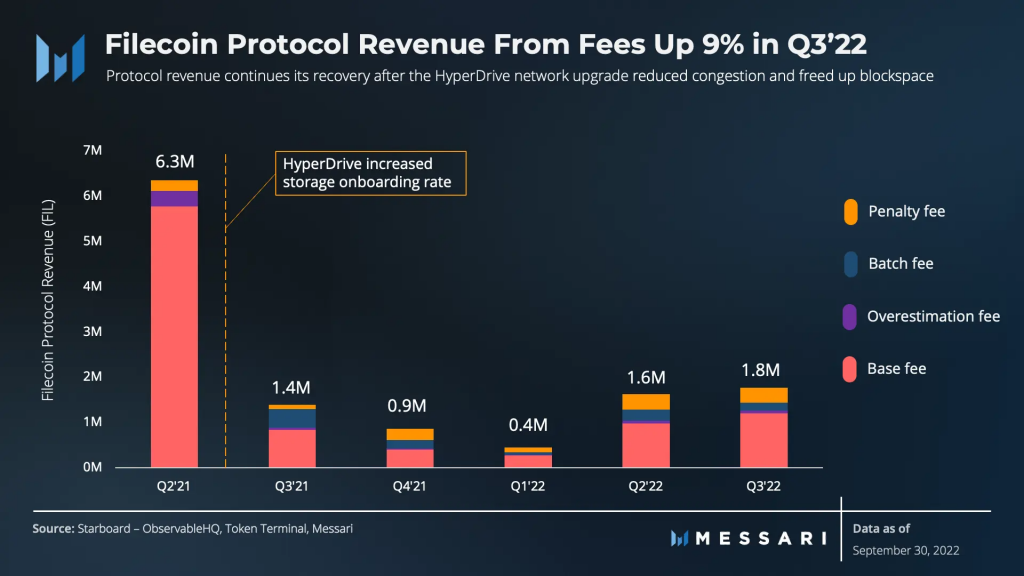

However, revenue (fees) has dropped sharply from its 2021 highs, when the project was generating millions in fees per day: as of this writing, the protocol is generating about $20,000 in fees per day.

Filecoin’s revenue consists of the following:

- Base fees: these are paid for any storage deal or proof. These fees vary based on message congestion on Filecoin.

- Batch fees: these are paid for adding storage capacity.

- Overestimation fees: these are paid for optimizing gas usage.

- Penalty fees: the network collects penalty fees from those who fail to provide storage as promised.

What caused the decline in revenue? In addition to falling crypto prices, the HyperDrive network upgrade was implemented in June 2021. The upgrade led to a 10-25x increase in network capacity, which has resulted in reduced congestion on the network.

While this is good for users, the upgrade reduced transaction fees, which drastically cut revenue in the subsequent quarters. (On the other hand, generating revenue through congestion is not a great business model.)

Network Storage and Usage Trends

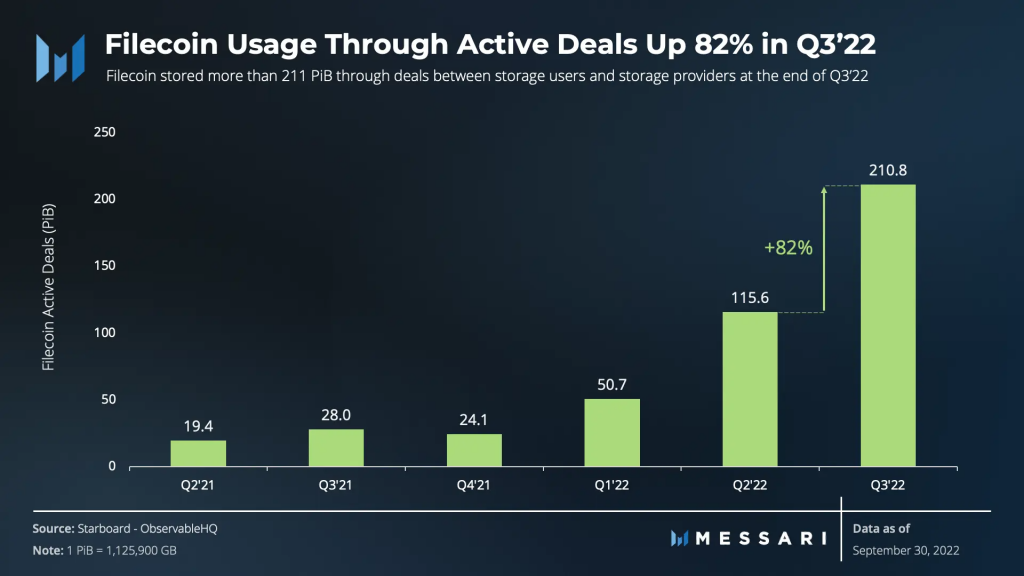

The easiest way to monitor the state of the Filecoin “business” is to measure the amount of data stored on the network. At the end of Q3, almost 211 pebibytes of data were stored on Filecoin, up 82% compared to the previous quarter, according to Messari. (1 PiB equals about 1.12 million GB.)

A major contributing factor is the introduction of the Filecoin Plus (Fil+) program, which acts as a layer of social trust and incentivizes the storage of real data. Since the launch of the program, Fil+ providers have undercut the fees of legacy storage providers, so that 98% of all new deals are Fil+ deals.

Network usage has also been ascending during the last few quarters, which is a positive fundamental signal for investors. Also, the momentum is still strong, especially after Filecoin launched two new specialized services to support usage growth – NFT.Storage and Web3.Storage. Both services have seen consistent growth since launch.

The Filecoin Ecosystem

The Filecoin ecosystem continues to grow rapidly, with the network attracting more users, storage providers, developers, and investors.

The four main use cases on Filecoins are:

- NFT and Web3 projects;

- Web2 datasets, including archival, education, health, social, public, and consumer storage;

- Metaverse and gaming projects;

- Video and audio content.

Today, over 500 projects are built on Filecoin, including projects like The Graph, OpenSea, Token Terminal, Opera, Slate, MetaMask, Ledger, and ConsenSys, among others.

The network is supported by several organizations that collaborate to improve and expand the ecosystem. Together, these organizations form the Ecosystem Working Group, which includes Protocol Labs, Filecoin Foundation, and Outercore, among others.

The Ecosystem Working Group has been nurturing a funnel of developers through a series of activities and events, such as accelerators, grants, hackathons, and growth support. These activities are meant to help new projects develop on Filecoin and receive funding.

The Future of Filecoin

While the ecosystem started as a data storage network that now provides over 18 EiB of distributed data storage capacity via thousands of storage providers globally, Filecoin wants to go one step further and become a multifunctional blockchain that could support a wide range of operations with the stored data.

To achieve this, Filecoin is gradually launching the Filecoin Virtual Machine (FVM), with the full release expected to happen during the first quarter of 2023. The FVM will enable users to deploy their own smart contracts to perform on-chain computation over state data in the Filecoin Network.

You can think of the current storage and retrieval functionality as being Layer 0 architecture, with the FVM as Layer 1. Some use cases of this major upgrade may include tokenized datasets, data-oriented decentralized autonomous organizations (DAOs), and trustless reputation systems.

FVM will also bring cross-chain interoperability bridges, connecting Filecoin to other major blockchains, including Ethereum, Solana, and NEAR, among others, making it the de facto standard for blockchain-based file storage.

For investors, this planned future of Filecoin may be more exciting than the present, with its roadmap including extra improvements related to data retrieval, off-chain computing, and scaling.

Investor Takeaway

Demand for cloud storage is increasing. Filecoin proposes a decentralized alternative to popular centralized platforms like Amazon Web Services and Microsoft Azure.

Filecoin aims to become one of the key players of the decentralized web, in which communities have control over their data. With the addition of smart contracts and programmability features to process datasets on the network, Filecoin is poised to become a unique blockchain player.

Filecoin may be a great investment option considering the accelerating growth of demand for decentralized storage. Besides purchasing the token on exchanges, another way to get exposure to the Filecoin ecosystem is to provide excess data in exchange for token rewards.

The price of FIL has taken a beating, in part because of the general “crypto winter,” but also because the price declined after the HyperDrive upgrade was implemented last year, which reduced revenues for the benefit of users.

We are impressed by the overall growth in network storage (Filecoin’s main “business”), as well as their commitment to continual innovation and ecosystem growth. The adoption of FVM should also bring new revenue streams from Layer-2 operations, which may drive increased demand for FIL.

For now, we’ll FIL this one under “a promising investment to watch.”

Subscribe to our crypto investing newsletter to get more investing tips delivered to your inbox (find out before the market does).

More Stories

U.S. Congressmen Seek Information Over Govt’s Crypto De-bank Efforts

Is It Worth Trading in Forex Markets in 2023?

Ethereum Outshines Bitcoin As Enthusiasm Grows