The US central lender will carry its benchmark policy fee higher than 4 per cent and keep it there over and above 2023 in its bid to stamp out higher inflation, in accordance to the the greater part of major academic economists polled by the Fiscal Instances.

The latest study, done in partnership with the Initiative on Worldwide Markets at the University of Chicago’s Booth University of Enterprise, implies the Federal Reserve is a very long way from ending its campaign to tighten financial policy. It has presently lifted fascination costs this calendar year at the most intense speed given that 1981.

Hovering close to zero as recently as March, the federal cash amount now sits between 2.25 for each cent and 2.50 per cent. The Federal Open Marketplace Committee gathers all over again on Tuesday for a two-day plan conference, at which officers are expected to implement a third consecutive .75 share position charge increase. That shift will hoist the fee to a new focus on array of 3 per cent to 3.25 per cent.

Just about 70 for each cent of the 44 economists surveyed among September 13 and 15 imagine the fed resources level of this tightening cycle will peak between 4 per cent and 5 per cent, with 20 per cent of the perspective that it will need to have to pass that level.

“The FOMC has nevertheless not occur to phrases with how superior they have to have to raise charges,” claimed Eric Swanson, a professor at the University of California, Irvine, who foresees the fed resources rate at some point topping out among 5 and 6 for each cent. “If the Fed needs to sluggish the economic climate now, they have to have to increase the money charge higher than [core] inflation.”

Even though the Fed normally targets a 2 for each cent rate for the “core” personal intake expenditures (PCE) cost index — which strips out volatile merchandise like food items and vitality — it carefully displays the shopper price tag index as effectively. Inflation unexpectedly accelerated in August, with the main evaluate up .6 for every cent for the thirty day period, or 6.3 per cent from the past calendar year.

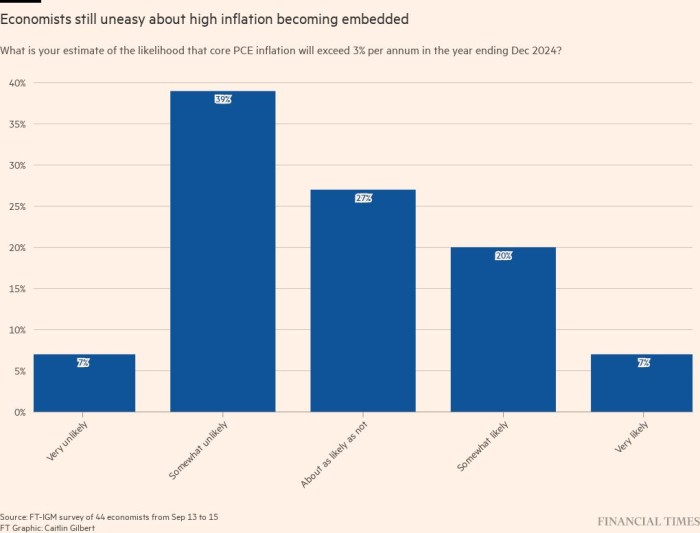

Most of the respondents task core PCE will fall from its most latest July level of 4.6 for every cent to 3.5 for every cent by the conclusion of 2023. But just about a third assume it to still exceed 3 for every cent 12 months afterwards. Another 27 for each cent stated “it was about as likely as not” to continue being higher than that threshold at that time — indicating excellent unease about significant inflation turning out to be far more deeply embedded in the economy.

“I worry that we have gotten to a position the place the Fed faces the danger of its believability very seriously eroding, and so it needs to start off being pretty cognisant of that,” explained Jón Steinsson at the College of California, Berkeley.

“We’ve all been hoping that inflation would commence to appear down, and we have all been unhappy around and more than and above again.” Far more than a third of the surveyed economists caution the Fed will fall short to adequately regulate inflation if it does not raise interest fees earlier mentioned 4 per cent by the conclusion of this yr.

Further than lifting premiums to a level that constrains economic action, the bulk of the respondents reckon the Fed will hold them there for a sustained period.

Easing rate pressures, monetary industry instability and a deteriorating labour marketplace are the most probable motives the Fed would pause its tightening campaign, but no lower to the fed funds fee is anticipated right up until 2024 at the earliest, according to 68 for every cent of those polled. Of that, a quarter do not foresee the Fed reducing its benchmark plan price until finally the next 50 % of 2024 or later.

Handful of believe, nonetheless, the Fed will increase its attempts by shrinking its stability sheet of almost $9tn through outright gross sales of its company house loan-backed securities holdings.

This kind of aggressive motion to interesting down the economic climate and root out inflation would have expenditures, a stage Jay Powell, the chair, has designed in modern appearances.

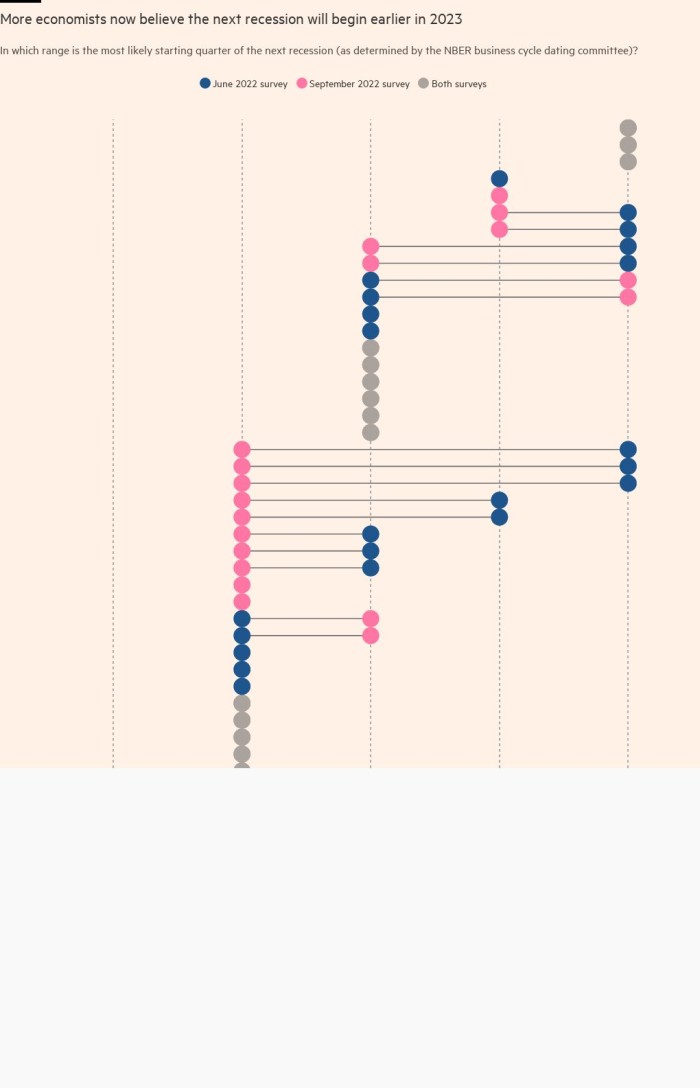

Nearly 70 for every cent of the respondents assume the National Bureau of Economic Investigation — the official arbiter of when US recessions get started and finish — to declare a single in 2023, with the bulk keeping the see it will manifest in the 1st or next quarter. That compares to the around 50 per cent who see Europe tipping into a recession by the fourth quarter of this year or previously.

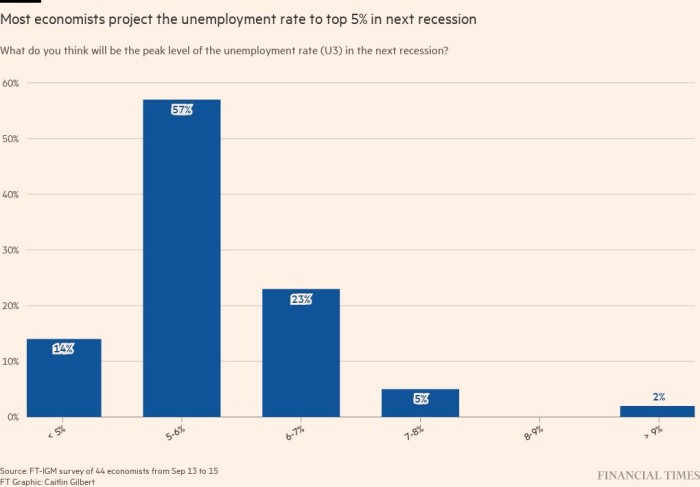

A US economic downturn is likely to extend throughout two or three quarters, most of the economists reckon, with more than 20 for each cent expecting it to past 4 quarters or additional. At its peak, the unemployment price could settle involving 5 for every cent and 6 per cent, according to 57 for each cent of the respondents, perfectly in extra of its present-day 3.7 for every cent stage. A third see it eclipsing 6 for every cent.

“This is heading to tumble on the staff who can least find the money for it when we have rises in unemployment owing to these price raises at some level,” warned Julie Smith at Lafayette School. “Even if it is tiny quantities — a percentage issue or two of boost in unemployment — that is real agony on real homes that are not organized to climate these sorts of shocks.”

An easing of supply-related constraints related to the war in Ukraine and Covid-19 lockdowns in China could aid minimise just how much the Fed requirements to damp demand, indicating a considerably less extreme financial contraction in the close,” mentioned Şebnem Kalemli-Özcan at the University of Maryland. But she warned the outlook is extremely uncertain.

“Clearly this is a single shock just after a further, so I’m not assured this is likely to transpire ideal away,” explained Kalemli-Özcan. “I can’t convey to you a timeframe, but it is going in the right direction.”

More Stories

Sarb hike: 50bps or 25bps?

Funds take record short position across U.S. Treasuries curve: McGeever

Philips buys Israeli co DiA Imaging Analysis