IBM (IBM) has not long ago been on Zacks.com’s record of the most searched stocks. Thus, you may possibly want to take into account some of the vital components that could influence the stock’s performance in the in the vicinity of long term.

Shares of this technological know-how and consulting enterprise have returned -6.4% around the previous thirty day period as opposed to the Zacks S&P 500 composite’s +7.8% adjust. The Zacks Pc – Integrated Systems industry, to which IBM belongs, has misplaced 2.5% over this time period. Now the crucial query is: The place could the inventory be headed in the in the vicinity of term?

Whilst media reports or rumors about a important alter in a firm’s company potential clients typically bring about its stock to craze and guide to an speedy cost alter, there are often certain basic elements that eventually push the obtain-and-hold conclusion.

Earnings Estimate Revisions

Here at Zacks, we prioritize appraising the improve in the projection of a firm’s long run earnings about nearly anything else. That’s simply because we consider the existing price of its long run stream of earnings is what decides the fair value for its stock.

Our evaluation is fundamentally primarily based on how offer-facet analysts masking the stock are revising their earnings estimates to get the most up-to-date company developments into account. When earnings estimates for a corporation go up, the reasonable benefit for its inventory goes up as well. And when a stock’s honest price is increased than its recent sector price tag, buyers have a tendency to get the stock, resulting in its cost going upward. Mainly because of this, empirical studies suggest a robust correlation between tendencies in earnings estimate revisions and limited-time period inventory rate actions.

IBM is anticipated to post earnings of $1.88 per share for the current quarter, representing a year-above-year modify of -25.4%. Around the final 30 times, the Zacks Consensus Estimate has adjusted -27.5%.

The consensus earnings estimate of $9.47 for the present fiscal year indicates a year-above-year change of +19.4%. This estimate has altered -4.3% above the past 30 times.

For the subsequent fiscal year, the consensus earnings estimate of $10.05 suggests a transform of +6.2% from what IBM is anticipated to report a year back. In excess of the earlier thirty day period, the estimate has adjusted -6.3%.

With an impressive externally audited track report, our proprietary stock rating software — the Zacks Rank — is a much more conclusive indicator of a stock’s around-expression cost performance, as it efficiently harnesses the electricity of earnings estimate revisions. The measurement of the new adjust in the consensus estimate, alongside with a few other things connected to earnings estimates, has resulted in a Zacks Rank #4 (Provide) for IBM.

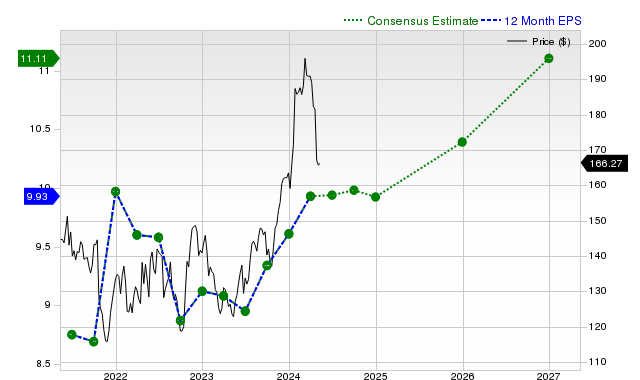

The chart under reveals the evolution of the firm’s ahead 12-thirty day period consensus EPS estimate:

12 Month EPS

Revenue Development Forecast

Although earnings expansion is arguably the most exceptional indicator of a company’s financial wellness, nothing comes about as this kind of if a company is just not equipped to increase its revenues. After all, it is approximately extremely hard for a company to maximize its earnings for an extended interval with no growing its revenues. So, it really is significant to know a firm’s possible profits advancement.

For IBM, the consensus sales estimate for the current quarter of $13.91 billion signifies a calendar year-around-year modify of -21%. For the existing and subsequent fiscal yrs, $59.9 billion and $61.2 billion estimates indicate -15.4% and +2.2% modifications, respectively.

Very last Claimed Effects and Surprise History

IBM reported revenues of $15.54 billion in the final noted quarter, symbolizing a yr-about-12 months transform of -17.1%. EPS of $2.31 for the very same period compares with $2.33 a yr in the past.

In comparison to the Zacks Consensus Estimate of $15.12 billion, the documented revenues symbolize a surprise of +2.75%. The EPS shock was +.87%.

In excess of the past four quarters, IBM surpassed consensus EPS estimates 3 occasions. The enterprise topped consensus revenue estimates two occasions about this period of time.

Valuation

With no looking at a stock’s valuation, no expenditure final decision can be efficient. In predicting a stock’s upcoming cost effectiveness, it can be critical to ascertain regardless of whether its present selling price effectively displays the intrinsic worth of the underlying business enterprise and the firm’s expansion prospective buyers.

While comparing the current values of a firm’s valuation multiples, these kinds of as rate-to-earnings (P/E), cost-to-gross sales (P/S) and value-to-cash move (P/CF), with its very own historic values helps ascertain no matter whether its inventory is pretty valued, overvalued, or undervalued, comparing the business relative to its friends on these parameters offers a superior feeling of the reasonability of the stock’s cost.

The Zacks Worth Design and style Score (part of the Zacks Model Scores procedure), which pays close attention to both equally standard and unconventional valuation metrics to grade stocks from A to F (an An is greater than a B a B is superior than a C and so on), is pretty helpful in figuring out no matter if a stock is overvalued, rightly valued, or quickly undervalued.

IBM is graded B on this entrance, indicating that it is trading at a discount to its peers. Simply click here to see the values of some of the valuation metrics that have driven this grade.

Base Line

The specifics talked about here and substantially other info on Zacks.com could possibly aid figure out no matter whether or not it is worthwhile paying out interest to the market place excitement about IBM. Nonetheless, its Zacks Rank #4 does recommend that it could underperform the broader current market in the near phrase.

Want the most up-to-date recommendations from Zacks Investment Investigation? Nowadays, you can down load 7 Ideal Shares for the Future 30 Times. Simply click to get this free report

Intercontinental Organization Equipment Company (IBM) : Free of charge Inventory Evaluation Report

To browse this report on Zacks.com click on below.

More Stories

Business email hosting trends and the future of email hosting

Want to be more present? Try taking out your phone

The Detailed Job Description of a Retail Buyer