Hennion & Walsh Asset Administration president and CIO Kevin Mahn analyzes Wall Street’s volatile working day on ‘The Claman Countdown.’

The Biden administration is seeking to get in advance of another potentially brutal economic report that arrives out future 7 days, which is expected to show the U.S. overall economy shrank once again in the spring — probably signaling a recession.

The Commerce Section is set to release the really expected 2nd-quarter gross domestic solution looking through Thursday morning, which is envisioned to display that advancement fell 1.6% in the period of time from March to May.

The GDP, the broadest measure of goods and products and services generated in the U.S., already shrank in the 1st quarter of the calendar year by 1.6%, marking the worst performance considering that the spring of 2020, when the economic climate was still deep in the throes of the COVID-induced recession.

Recessions are technically described by two consecutive quarters of negative financial growth and are characterized by significant unemployment, very low or destructive GDP expansion, slipping cash flow and slowing retail revenue, in accordance to the National Bureau of Economic Investigation (NBER), which tracks downturns.

WHY IS INFLATION However SO Large, AND WHEN WILL IT Start TO Amazing?

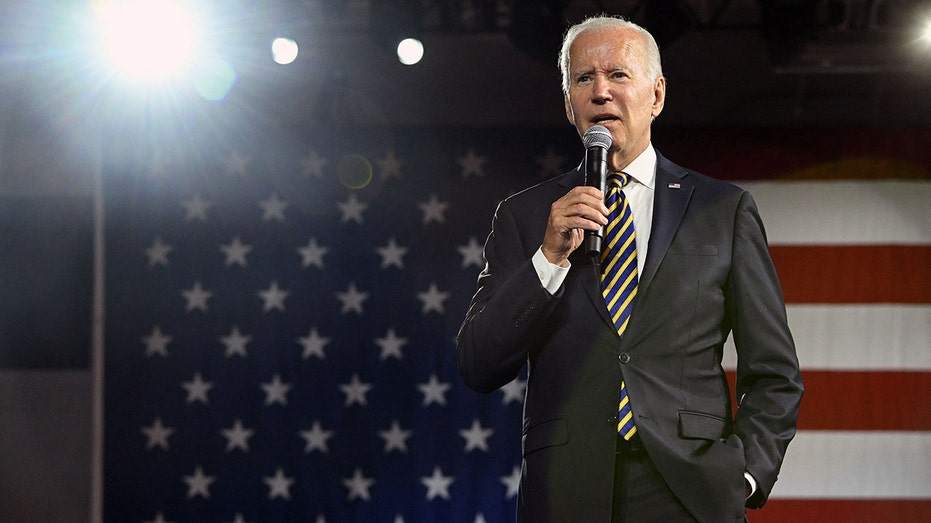

President Biden speaks about the economic system and the remaining rule applying the American Rescue Designs Special Monetary Guidance system, defending multi-employer pension ideas, at Max S. Hayes Significant School in Cleveland, Ohio, on July 6, 2022. (SAUL LOEB/AFP by using Getty Pictures / Getty Photos)

Really should the financial state decline in the next quarter, it could fulfill the technological standards for a recession, which calls for a “substantial drop in economic action that is spread across the economic system and that lasts extra than a few months.” Even now, the NBER — the semi-official arbiter — may well not affirm it quickly.

The White Dwelling is now trying to find to redefine what constitutes a economic downturn prior to the knowledge launch, which is possible to demonstrate two consecutive durations of shrinkage. In a new blog submit, White Dwelling Council of Economic Advisers chair Cecilia Rouse and member Jared Bernstein argued the financial system is nowhere in the vicinity of a downturn as described by the NBER.

“Whilst some preserve that two consecutive quarters of slipping actual GDP constitute a economic downturn, that is neither the formal definition nor the way economists assess the point out of the organization cycle,” they wrote, noting that a “holistic” tactic takes into account the labor market, customer and enterprise paying, industrial production and incomes. “Dependent on these information, it is not likely that the decline in GDP in the very first quarter of this 12 months — even if adopted by yet another GDP drop in the 2nd quarter — implies a recession.”

There are increasing fears on Wall Street that the Federal Reserve will trigger a downturn as it raises fascination fees at the speediest pace in 3 many years as it races to catch up with runaway inflation.

A man putting on a mask walks previous the U.S. Federal Reserve developing in Washington on April 29, 2020. (Xinhua/Liu Jie by way of Getty Images / Getty Visuals)

Fed policymakers permitted a 75-foundation level desire rate hike in June — the first considering the fact that 1994 — pushing the federal funds concentrate on array to 1.5%-1.75%. One more hike of that magnitude is on the desk in July amid signals of stubbornly high inflation, Chairman Jerome Powell explained to reporters following the meeting, prompting investors to reassess the financial outlook.

Hiking fascination fees tends to generate greater premiums on purchaser and business enterprise financial loans, which slows the financial system by forcing employers to reduce back on shelling out. Mortgage prices are already approaching 6%, the optimum because 2008, though some credit history card issuers have ratcheted up their costs to 20%.

Even though Powell has said the central financial institution is not making an attempt to induce a economic downturn, he has not ruled out the possibility of a downturn and has admitted the odds of a thriving “smooth landing” are getting narrower.

Click In this article TO Read through Additional ON FOX Enterprise

“There’s a route for us to get there,” Powell informed reporters at a put up-conference press meeting in June, referring to a gentle landing. “It’s not receiving a lot easier. It is having extra complicated.”

More Stories

How to Use Leverage in Bonds CFD Trading Effectively

The E-commerce Business Boom: What You Need to Know

Pros and Cons of Starting a Dropshipping Business