We often talk about the usefulness of information in building financial commitment conclusions. Basing investments on dependable info is an crucial stage for any crypto trader. This applies to the two on-chain and off-chain facts and knowing both of those is a requirement for anyone scheduling on investing in or investing cryptocurrencies.

On-Chain Information

To retain it easy, “on-chain” information is anything recorded and stored immutably on the blockchain. This involves wallet addresses, transactions, transfers, and any other data that is stored in blocks. All this facts is gathered from blockchain nodes and is thoroughly viewable by different blockchain explorers. On-chain information is the most broadly employed in crypto investigation.

On-Chain Transaction Rewards:

- Stability: For the reason that blockchain details is encrypted and immutable, it is typically dependable and secure.

- Decentralization: The deficiency of centralization tends to make blockchain knowledge trusted as there are no third get-togethers that could manipulate the info.

- Transparency: Since blockchains use dispersed ledger technological know-how, each individual transaction is recorded and validated in multiple places concurrently. This will allow for impartial verification of transactions.

On-Chain Transaction Downsides:

- Sluggish: Blockchain transactions can be gradual if network congestion boosts thanks to spikes in the quantity of transactions ready to be processed.

- Superior Network Charges: Enhanced transaction volumes can lead to enhanced network charges. This can make transacting on the blockchain an pricey proposition at times.

- Vitality Usage: Blockchains applying proof of work for consensus are recognised to use a terrific offer of vitality in the mining procedure.

Off-Chain Info

Off-chain info is information that’s established but not saved on the general public blockchain.

The ideal-recognised example of off-chain knowledge is the use of central buy guides by crypto exchanges. They will need purchase e-book information to match sellers with buyers and to execute trades, but the knowledge is not composed to the blockchain. Instead, it’s held by a centralized crypto trade, and it is up to the exchange how substantially of this details will be publicly offered. The great thing about this form of details is it’s specialised and will allow for the generation of crypto indices, reference costs, and other marketplace knowledge solutions.

“Off-chain” could also imply the info is not on a public blockchain. There are a lot of private blockchains that act like non-public cloud storage, thus allowing for corporations to store blockchain information privately.

Off-chain transactions have great price for corporations. Not only do they usually have the stability afforded by the blockchain, but they have amplified protection because they’re non-public.

They are also not subject to the transactional velocity limitations normally located with on-chain transactions. It’s recognised that most blockchains have troubles with transaction speeds for the reason that of confirmation processes. Off-chain transactions sidestep challenges involved with demanding confirmation from all blockchain participants. They are therefore quicker when in contrast with on-chain transactions. As these off-chain devices are commonly not public-facing, they can be extra secure.

Off-Chain Program Positive aspects:

Quicker Transaction Speeds: Because off-chain transactions do not will need to wait around for confirmations from blockchains, they’re substantially quicker. In some instances, they’re even instantaneous.

Decreased Price tag: Simply because off-chain transactions really don’t need validation through mining or staking, there are couple service fees (or zero expenses).

Increased Anonymity: Because off-chain transactions really don’t get broadcast to the general public blockchain, they supply greater privacy.

Off-Chain Technique Downsides:

Less Transparency: Off-chain transactions absence transparency. This could lead to disputes relating to their validity.

Third-Social gathering Belief Issues: A deficiency of consensus methods indicates validation may possibly be in the arms of 3rd-occasion intermediaries. This can guide to rely on troubles.

Probably Much less Protected: Data outside the immutability of the blockchain is much more vulnerable to manipulation. This could lead to fraud.

When analyzing any crypto job, both equally on-chain metrics and off-chain metrics can be valuable. Comprehending the strengths and weaknesses of both equally can assistance to decide the bodyweight supplied to each and every sort of knowledge in the course of this evaluation.

Crypto Analysis with On-Chain and Off-Chain Information

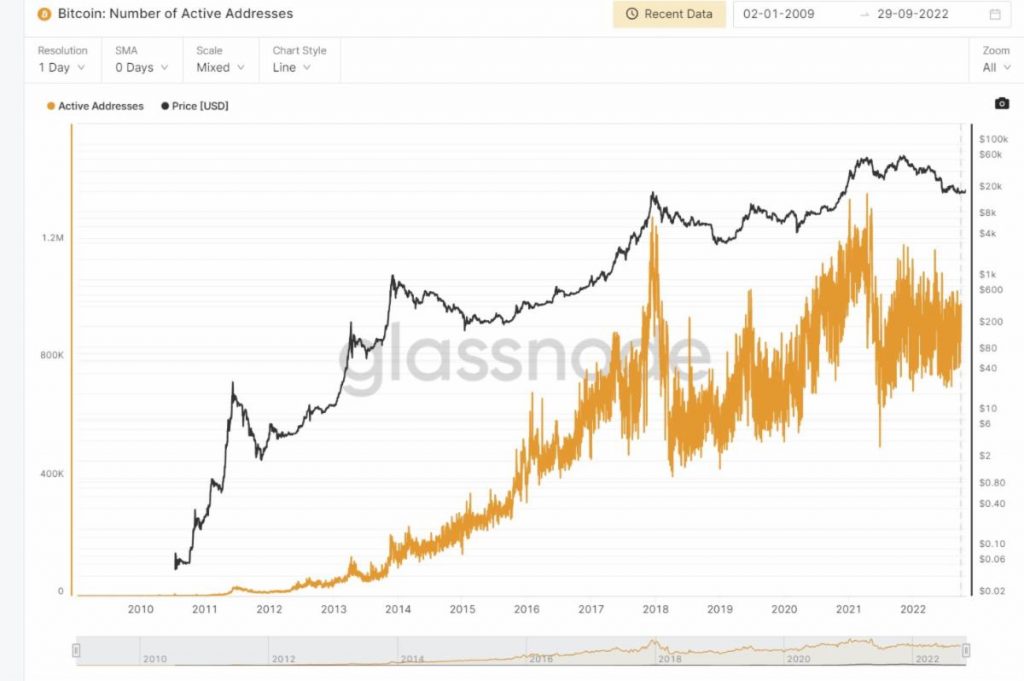

On-chain information is more usually utilised in examination, specifically when looking at market place sentiment. As on-chain info seems precisely at genuine-time transactions and balances, it can be quite practical in deciding whether or not a token is a great expense or not at any specified time. If a token is managed by a modest quantity of whale accounts or is thinly traded, it may well be a inadequate investment preference.

Off-chain info can be equally beneficial in crypto examination if the third-get together storing and supplying that data is honest. Degree 2 solutions like the BTC Lightning Network or Optimism for Ethereum insert to the utility of their respective blockchains. As these answers see increased use, the knowledge gathered from them can assistance establish no matter if a sure token is a superior investment alternative.

Beneficial On-Chain Applications

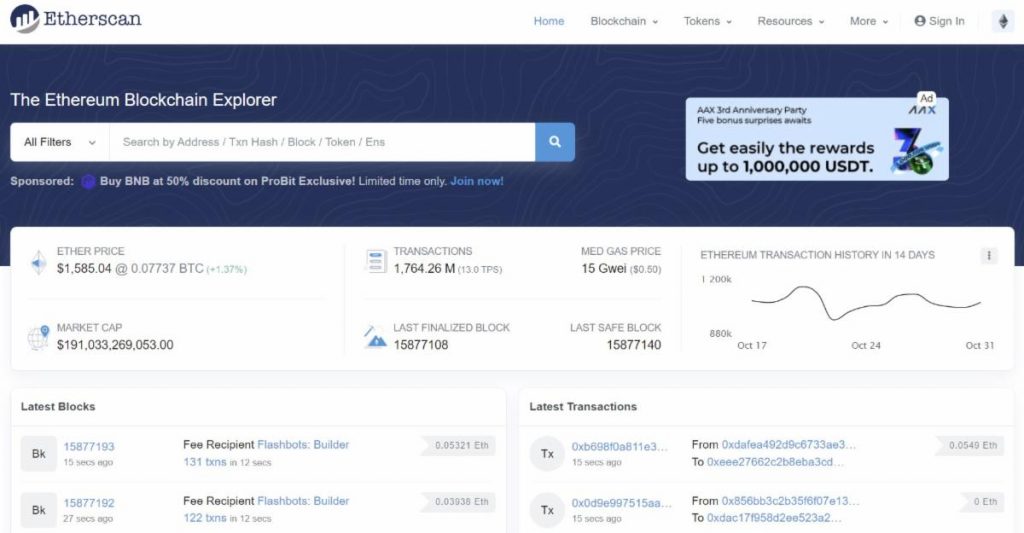

For raw data, blockchain explorers like Etherscan for Ethereum or Solscan for Solana are the gold conventional. They let you watch all the facts saved to a blockchain like transactions, wallet addresses, wise contracts, and NFTs. Having said that, they only present raw info. A lot more handy to typical traders are the equipment that combination the details to make sense of this information.

A quantity of beneficial analytics platforms have sprung up that can support make perception of the broad amounts of details stored on blockchains. Some are no cost have grow to be go-to resources for coherent knowledge pertaining to blockchain activity. Some of the more well-known assessment platforms involve:

- Glassnode

- IntoTheBlock

- Nansen

- Dune Analytics

- Messari

You’ve probable viewed information and charts from various of these platforms involved in past BMJ newsletters and web site posts, and for very good purpose. They’re the prime details vendors and have develop into trusted in conditions of the details they provide.

We’ll glance further into methods all this on-chain details can be employed in a person of our potential BMJ columns. In the meantime, it could be truly worth your though to go investigate the analytics platforms higher than.

Trader Takeaway

You can find good utility in equally on-chain and off-chain details relying on your use case. Knowledge the strengths and weak spot of just about every is a superior starting off issue for those searching to do their have investigate and analysis of several blockchain assignments and cryptocurrencies.

Whilst on-chain facts is thought of the gold common for crypto analysis, there’s significantly to be mentioned for off-chain info as very well. Without off-chain data, we could not have indices, reference rates, or other crypto sector items.

Just as a mixture of elementary and complex assessment can assistance when studying an asset, a mix of on-chain and off-chain info can be helpful for examining crypto and blockchain tokens.

More Stories

U.S. Congressmen Seek Information Over Govt’s Crypto De-bank Efforts

Is It Worth Trading in Forex Markets in 2023?

Ethereum Outshines Bitcoin As Enthusiasm Grows