Are you looking to invest in cryptocurrencies but unsure which one to buy? With so many options available, it can be overwhelming to decide how to invest your money. That’s why we’ve compiled a list of the best crypto to buy now, based on factors such as project developments, price performance and market capitalization, as well as the overall potential for growth.

In this article, we’ll take a closer look at the most promising cryptocurrencies, including staples such as Bitcoin and Ethereum, and a combination of several other promising crypto projects. We’ll discuss their features, advantages, and potential drawbacks, as well as provide insights into market trends. Whether you’re a seasoned investor or just starting out, this article will help you make an informed decision about the best crypto to buy now.

So, let’s dive in and explore the best cryptocurrencies to invest in 2023:

- Ethereum – The leading DeFi and smart contract platform

- Polygon – A popular scaling solution for Ethereum

- Baby Doge Coin – One of the most promising “meme coin” projects

- Bitcoin – The world’s oldest and largest crypto

- BNB – The native asset of the BNB Chain and Binance ecosystem

- Cosmos – A leading interoperability-focused blockchain projects

- TRON – A popular dApp and decentralized storage network

- Shiba Inu – A NFT, DeFi, and blockchain gaming project

- Maker – A leading DeFi protocol featuring the Dai stablecoin

- Lido – The leading liquid staking solution for Ethereum, Solana, and others

- Aptos – A high-performance Layer 1 blockchain

- Uniswap – The largest decentralized exchange in the crypto sector

Best cryptos to buy right now

The following three cryptocurrency projects highlight our investment selection thanks to important developments and upcoming events that make them especially interesting to follow in the near future. These projects are updated each week based on the most recent developments and trends taking place in the crypto market.

1. Ethereum

Launched in 2015 by Vitalik Buterin and a team of developers, Ethereum is a decentralized, open-source blockchain platform that allows developers to build decentralized applications (dApps) and smart contracts.

Ethereum has a wide range of use cases beyond just a store of value or medium of exchange. Ethereum’s smart contract functionality allows developers to build dApps that can run without the need for intermediaries, like centralized servers or institutions.

The Ethereum platform has gained widespread adoption and has become the backbone of the decentralized finance (DeFi) industry. DeFi applications built on Ethereum allow users to access financial services without relying on traditional banks or financial institutions. Ethereum’s smart contract functionality has also enabled the creation of non-fungible tokens (NFTs), which have gained popularity in the digital art and gaming worlds.

While Ethereum has a strong community and has been highly influential in the cryptocurrency industry, it also faces challenges, such as scalability issues and high gas fees. These issues have spurred the development of various Layer 2 scaling solutions. In the long run, future updates are supposed to massively increase Ethereum’s throughput bringing the transaction per second (TPS) figure from 15 to 100,000.

Why Ethereum?

Following last year’s Merge, which saw Ethereum transition from Proof-of-Work (PoW) to Proof-of-Stake (PoS), the next major upgrade to hit the Ethereum network could be going live next month. “Shanghai”, as the new upgrade is called, will unlock ETH locked in the Beacon Deposit Contract, giving validators a chance to withdraw their assets. At the moment, there are over $26 billion worth of ETH locked in the contract. The dev team stated the following:

“Full withdrawals will be available for exited validators, whereas partial withdrawals will be available for active validator balances in excess of 32 ETH.“

According to Ethereum developer Tim Beiko, the mainnet upgrade could go live as soon as late March or early April. Recently, the supply of Ethereum on cryptocurrency exchanges has plunged by over 35% since the Merge upgrade, which suggests that users are withdrawing their ETH as Shanghai approaches. Typically, exchange outflows are considered a bullish sign, which is reflected in our algorithmically generated ETH price prediction as well.

2. Polygon

Polygon, formerly known as Matic Network, is a Layer 2 scaling solution for Ethereum that aims to provide faster and cheaper transactions while maintaining the security and decentralization of the Ethereum network.

Polygon uses a PoS consensus mechanism to validate transactions, which reduces the energy consumption and environmental impact of the network compared to the PoW consensus, which is most prominently used by Bitcoin. By using Polygon, developers can build and deploy dApps with lower fees, faster transaction speeds, and a better user experience.

The native cryptocurrency of Polygon is MATIC, which is used for transactions, staking, and governance on the network. MATIC is an ERC-20 token, meaning it runs on the Ethereum blockchain and can be stored in any wallet that supports ERC-20 tokens.

Polygon has gained popularity in the cryptocurrency industry as a solution to Ethereum’s scalability issues and has been adopted by various dApps, including Aave, Sushiswap, and Curve Finance. The network has also partnered with other blockchain projects, including Polkadot and Chainlink, to enable cross-chain interoperability.

Why Polygon?

The Polygon team has announced that Polygon zkEVM Public Beta will be launching on the Polygon mainnet on March 27. zkEVM, or zero-knowledge Ethereum Virtual Machine, is a virtual machine that generates zero-knowledge proofs to verify the correctness of programs.

Polygon’s zkEVM solution can execute smart contracts in a way that’s compatible with zero-knowledge-proof technology used by Ethereum. This means that developers can easily onboard dApps from Ethereum to Polygon’s zkEVM platform.

Here’s what the Poygon devs wrote about the upcoming update:

“True EVM-equivalence means that Ethereum can be scaled without resorting to half-measures. The best way to scale Ethereum is to preserve the existing Ethereum ecosystem: code, tooling, and infrastructure needs to just work. And that’s what Polygon zkEVM is aiming to achieve.”

3. Baby Doge Coin

Baby Doge Coin is a relatively new cryptocurrency that was created as a spinoff of the popular Dogecoin. It was launched in June 2021 and has quickly gained a lot of attention in the cryptocurrency world. As its name suggests, Baby Doge Coin is based on the meme-inspired cryptocurrency Dogecoin, which has gained a cult-like following over the years. Baby Doge Coin aims to build upon the popularity of Dogecoin and create a more sustainable and community-driven token.

Baby Doge Coin is a decentralized, peer-to-peer (P2P) digital currency that uses blockchain technology to enable fast and secure transactions. It operates on the BNB Smart Chain (BSC) and uses a deflationary tokenomics model, where a portion of each transaction is burned, reducing the total supply of the token over time.

The developers of Baby Doge Coin have focused on building a strong community around the project, with regular social media updates and events. They have also pledged to donate a portion of the project’s profits to various animal welfare organizations, which has helped to build a positive image for the project.

Like any other cryptocurrency, Baby Doge Coin has its risks, and its value can be highly volatile. As a newer cryptocurrency, it also carries a higher level of uncertainty than more established projects.

Why Baby Doge Coin?

In the past couple of weeks, several encouraging signs have emerged that support the meme coin’s recent price increase. After all, the price of BABYDOGE surged by over +300% since the start of the year, making it one of the best-performing crypto assets of 2023.

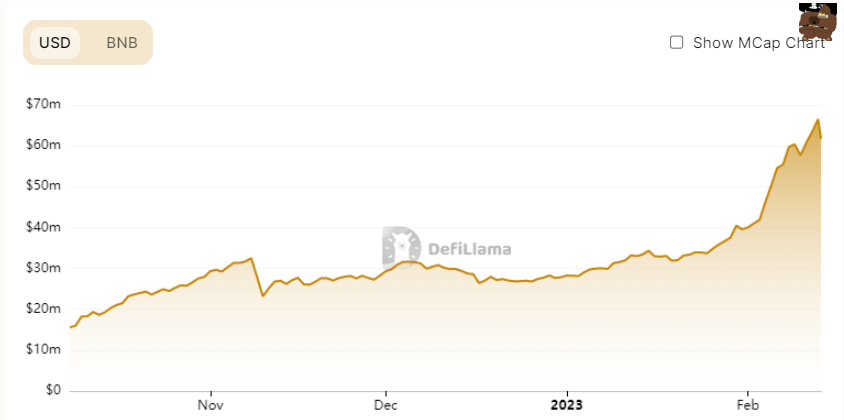

There are several reasons why the price of Baby Doge Coin has increased recently. For starters, the decentralized finance (DeFi) activity in the ecosystem has increased substantially, growing from a TVL of $28 million to $62 million in the last month and a half, according to DeFi Llama.

Secondly, the Baby Doge Coin team launched a community burn portal on February 13, promising to burn 5 extra tokens for each token burned by users. “If community burns 1 quadrillion tokens through the portal we will burn 5 quadrillion more,” the team stated on Twitter. The deflationary pressure could help BABYDOGE reach new highs. Check our Baby Doge Coin price prediction to see where it could be headed next.

Finally, the currency has recently been trending on Binance, the world’s largest cryptocurrency exchange. Given the fact that BABYDOGE is not listed for trading on the platform, its trending status suggests that it could see substantial growth should Binance decide to list it.

The best cryptocurrencies to invest in 2023

4. Bitcoin

Bitcoin (BTC) is the original decentralized digital currency, enabling peer-to-peer transactions without the need for intermediaries such as banks or financial institutions. It was created in 2009 by an unknown person or group of people using the pseudonym Satoshi Nakamoto. Bitcoin was the first digital currency to eliminate the double spending problem without resorting to any central intermediaries.

Bitcoin transactions are recorded on a public ledger called the blockchain, which is maintained by a network of computers around the world. This means that the transactions are secure and transparent, as anyone can view them but they are also anonymous, as the identity of the participants in the transaction is not revealed.

BTC can be bought and sold on cryptocurrency exchanges, and they can be stored in a digital wallet, which is a software program that securely stores private keys that are required to access and transfer the currency.

Bitcoin is often referred to as “digital gold” or a store of value, as it has a limited supply of 21 million coins, and its value is determined by market demand. Some people also see it as a hedge against inflation or a way to diversify their investment portfolio. It is by far the largest cryptocurrency by market cap in the industry, accounting for the value of more than 40% of all digital assets in circulation combined, making it arguably the most popular crypto to buy.

Why Bitcoin?

Bitcoin is the oldest and most widespread cryptocurrency in the world. These qualities give it certain characteristics that virtually every other cryptocurrency lacks. For starters, Bitcoin is owned by millions of people around the world. According to an Intotheblock report from 2022, there are about 40 million Bitcoin holders.

Secondly, Bitcoin has successfully withstood the test of time. While thousands of crypto projects have come and gone in the nearly 15 years since the first private cryptocurrencies were created, Bitcoin has only increased its market cap, number of addresses, and adoption among both individuals and institutions.

Finally, the next Bitcoin halving event is approaching and is expected to take place in late March 2024. Bitcoin halving is an event that halves the rewards miners received for each block. In the next halving, the fourth one in Bitcoin history, this reward will drop from 6.25 BTC to 3.125 BTC.

Historically, each Bitcoin halving cycle has brought new all-time highs, supporting the argument of those that advocate buying Bitcoin ahead of a halving event. Here’s a quick breakdown of the highest and lowest prices in each cycle as well as the BTC price at the time of each halving:

| Lowest Price | Highest Price | BTC Price at Date of Halving | |

| 1st Halving Cycle (Nov 2012 – Jul 2016) | $12.4 | $1,170 | $12.3 (Nov 28, 2012) |

| 2nd Halving Cycle (Jul 2016 – May 2020) | $535 | $19,400 | $680 (Jul 9, 2016) |

| 3rd Halving Cycle (May 2020 – Mar 2024)* | $8,590 | $67,450 | $8,590 (May 11, 2020) |

5. BNB

BNB (formerly Binance Coin) is a cryptocurrency created by the popular cryptocurrency exchange Binance. Binance is the largest cryptocurrency exchange in the world, allowing users to buy, sell, and trade a wide range of digital assets.

BNB was initially one of the ERC-20 tokens on the Ethereum blockchain but has since migrated to its own blockchain, known as BNB Chain. BNB is used as a utility token within the Binance ecosystem and has a variety of use cases. For example, users can use BNB to pay for transaction fees on the Binance exchange, receive discounts on trading fees, participate in token sales on Binance Launchpad, and purchase goods and services from merchants that accept BNB as payment.

One of the unique features of BNB is that it has a deflationary model. Binance uses a part of its profits each quarter to buy back and burn BNB tokens, reducing the total supply of the token over time. This mechanism is designed to create scarcity and increase the value of BNB over time, with the end goal of reducing the circulating supply of BNB from the initial 200 million to 100 million BNB.

Why BNB?

While Binance has been trying to distance itself from the BNB coin with moves such as the renaming from Binance Coin to BNB and stating that the project is open source and owned by the community, it is clear that the world’s largest exchange still has a large stake and say in how BNB is developed.

This means that an investment in BNB is indirectly an investment in the Binance broader ecosystem, at least in principle. And the Binance ecosystem is one of the quickest growing in the industry.

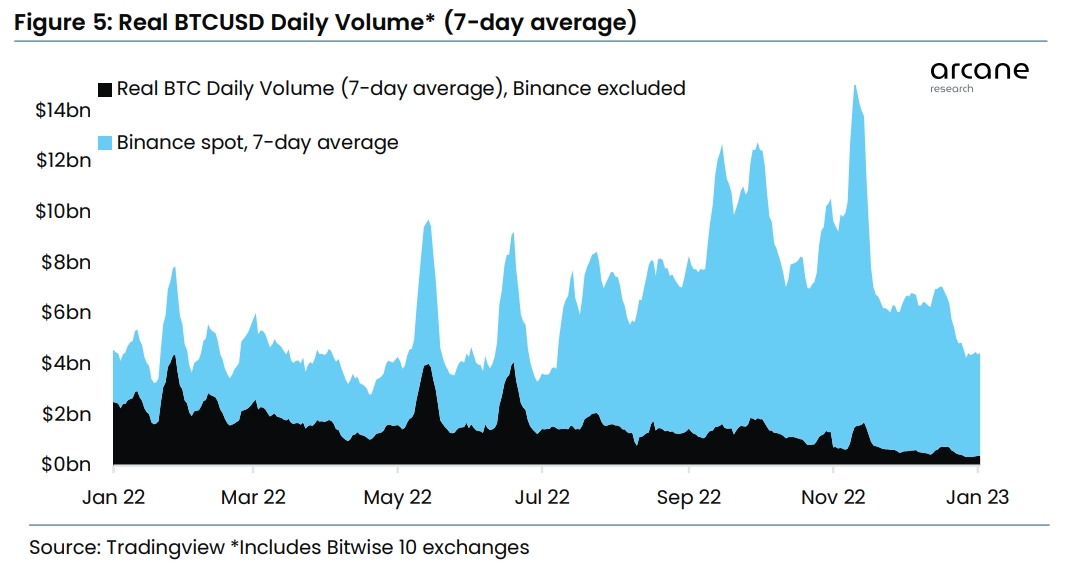

Last year, Arcane Research reported on the extent to which Binance has captured the crypto spot trading market. According to them, Binance’s share of the Bitcoin spot market trading volume surpassed 90% on December 28, more than double what it was at the beginning of 2022 (from 45% to 92%).

In addition to the exchange domination, the BNB Smart Chain (BSC) has also seen a massive rise in popularity in recent months. According to DeFi Llama, BSC is the third largest DeFi ecosystem in terms of total value locked (TVL) with $4.91 billion, trailing only TRON ($5.16B TVL) and Ethereum ($28.67B TVL).

Given these metrics, it’s hard to argue against BNB being a good investment. However, that could quickly change, especially if Binance faces more regulatory scrutiny in the future.

6. Cosmos

Cosmos is a blockchain project designed to enable the interoperability and scalability of different blockchain networks, dubbed the “Internet of Blockchains”. The native cryptocurrency of the Cosmos network is called ATOM.

Cosmos aims to address some of the key challenges facing the blockchain industry, including the lack of interoperability between different blockchain networks, scalability issues, and the need for greater efficiency in transaction processing.

The Cosmos network achieves interoperability by allowing different blockchains to communicate with each other through a shared hub called the Cosmos Hub, which acts as a central point of communication for different blockchains, enabling them to transfer assets and data between each other.

The Cosmos network also utilizes a PoS consensus mechanism, which allows for greater scalability and energy efficiency compared to PoW consensus mechanisms. Overall, Cosmos aims to create a more interconnected and scalable blockchain ecosystem, and the ATOM cryptocurrency is used to incentivize participation in the network and facilitate transactions.

Why Cosmos?

Interchain Foundation has announced new participants will be joining the Builders Program in 2023. Interchain Foundation is an organization aimed at developing and maintaining an “interoperable multichain future” on Cosmos

In total, the program received 80 applications, out of which 18 had been selected for the program. The teams are focusing on various aspects of blockchain applications, from DeFi and infrastructure to gaming and non-fungible tokens (NFTs).

It is worth mentioning that the program saw more than 50 teams join the Builders Program in 2022 following its June launch. The interest in building on the interoperability-focused ecosystem and using the Inter-Blockchain Communication Protocol (IBC) bodes well for the future of Cosmos.

7. TRON

TRON is a decentralized blockchain platform that aims to build a global digital content storage system with distributed storage technology. The platform allows users to publish, store, and own data in a decentralized manner, while also offering the ability to create and publish their own content.

TRON leverages the power of the BitTorrent File System (BTFS) to provide a venue for individuals and businesses to store files that are not stored in a centralized data center, but rather decentralized across various computers and accessible via dedicated protocols. Also, TRON launched an algorithmic stablecoin USDD in 2022, which is pegged to the value of the US Dollar at a 1:1 ratio.

The project was founded by Chinese entrepreneur Justin Sun, and its development is overseen by the Tron Foundation, which was established in 2017. TRX is the native token of the TRON blockchain and is used to pay for transactions on the network and access various decentralized applications built on the platform. In addition, TRX is also used for decentralized governance purposes.

Before the launch of the TRON mainnet, TRX existed in the form of an ERC-20 token on the Ethereum blockchain. After the launch of its own blockchain in June 2018, TRON quickly grew to become a major player in the blockchain sector and has positioned itself as a competitor to Ethereum with a focus on providing high throughput and scalability for decentralized applications and content platforms. Similarly to Ethereum, the TRON blockchain can also host custom its own digital assets, issued using the TRC10 and TRC20 standards.

Why TRON?

In the first half of February, the Tron Foundation announced the launch of a $100 million AI development fund with the aim of supporting cryptocurrency projects that are focused on building artificial intelligence (AI) solutions.

The announcement comes at a time when the interest in AI has reached an all-time high, largely due to the launch of OpenAI’s massively popular AI chatbot called ChatGPT.

The TRON team has stated that organizations working on AI-related TRON-based projects that are aligned with the mission and vision of the Foundation will benefit from both financial as well as technical support.

The AI development fund will focus on projects that are working on four key areas, namely, the creation of an AI service payment platform, AI-infused oracles, AI-informed investment management services, and AI-generated content. However, the development fund is just a part of TRON’s wider push to integrate AI with its blockchain. Justin Sun recently said that TRON would develop and offer an AI-oriented decentralized payment framework for AI systems as well.

8. Shiba Inu

Shiba Inu is a cryptocurrency that was created in August 2020 by an anonymous person or group of people under the pseudonym “Ryoshi”. It is an ERC-20 token on the Ethereum blockchain, which means it is a digital asset that is compatible with the Ethereum network and can be stored in any wallet that supports ERC-20 tokens.

Shiba Inu gained popularity in 2021 after it was listed on several cryptocurrency exchanges and gained attention on social media platforms like Twitter and Reddit. In fact, SHIB’s 2021 run is still one of the most impressive runs in crypto history, as the meme coin gained over 430,000x in a span of the year. It is often compared to Dogecoin, another meme-inspired cryptocurrency, as it features the Shiba Inu dog breed as its mascot.

However, unlike Dogecoin, the project aims to create a decentralized ecosystem for a variety of use cases, including decentralized exchanges, NFTs, and more. The development team has also created a Shiba Inu-themed decentralized exchange called ShibaSwap.

Why Shiba Inu?

With a circulating supply of roughly 550 trillion tokens and a market cap of over $7.5 billion, Shiba Inu is unlikely to reach milestones many users want to see, such as 1 dollar, 50 cents, or even 1 cent. The reason is simple, if SHIB were to reach 1 dollar, for instance, its market cap would be $550 trillion. That’s just not feasible.

However, the upcoming Shibarium layer 2 solution could change that in a big way. Shibarium is a scaling solution for Shiba Inu that aim to make transactions cheaper and faster. In addition, Shibarium will burn SHIB for each transaction made on the platform, which will introduce deflationary pressure and lower the total number of SHIB in circulation over time.

Users hope that Shibarium will not only make it cheaper and more efficient for NFT and DeFi projects to leverage Shiba Inu, but also lead to a massive appreciation in the price of the Shiba Inu coin. Recently, the Shiba Inu team announced that the testing of Shibarium is already underway and added that the solution should be launching “soon”. If successful, Shibarium could be a major catalyst for Shiba Inu and one of the reasons why it could be one of the best coins to buy in 2023.

9. Maker

Maker is a cryptocurrency that is part of the MakerDAO project, which is a DeFi protocol built on the Ethereum blockchain. The project oversees an algorithmic stablecoin called Dai, which is pegged to the US dollar and is backed by collateral consisting of several stablecoins and cryptocurrencies, including USDC, USDP, ETH, WBTC, and others.

MakerDAO is a complex DeFi ecosystem that operates using smart contracts on the Ethereum network. At its core, the MakerDAO protocol allows users to lock up collateral in the form of ETH and other tokens, in exchange for the Dai stablecoin. This allows users to access a stable and decentralized cryptocurrency that can be used for payments, trading, and other financial transactions.

The MKR token is used to govern the MakerDAO ecosystem. Holders of MKR can vote on proposals and changes to the protocol, including setting the stability fee (interest rate) for loans and determining which assets can be used as collateral. MKR holders also receive a share of the fees generated by the MakerDAO system.

One important feature of MakerDAO is that the value of the Dai stablecoin is maintained through a system of over-collateralization, meaning that the value of the collateral backing the Dai stablecoin is worth more than the value of Dai itself. If the value of the collateral falls below a certain threshold, the collateral is automatically sold off to maintain the stability of the system.

Why Maker?

In an early February post, the Maker team announced the launch of Phoenix Labs, a research and development company developing the Spark Protocol. The Spart Protocol is Phoenix Labs’ first solution, aiming to create a user-friendly “front-end for interacting with DAI” that functions much like Aave V3, a massively popular DeFi protocol.

The first product to launch under the Spark Protocol umbrella will be Spark Lend (SL), a lending market aiming to integrate Maker’s D3M and the PSM. Here’s how the developers described SL’s goals:

“Spark Lend will focus on scalable types of collateral that are highly liquid. SL will not compete with markets that offer “tail assets”. By focusing on highly liquid, decentralized assets with large market caps, SL will aim to be the most secure platform in all of DeFi.”

After SL, Phoenix Labs plans to roll out other products and services throughout 2023, including Spark Fixed Rates, Resilient Oracles, cross-chain support, Maker teleport support, and bootstrapping of EtherDAI (see image above).

10. Lido DAO Token

Lido is a DeFi project that allows users to earn rewards on their cryptocurrency holdings by staking them on several blockchain networks, including Ethereum, Polygon, Solana, Polkadot, and Kusama.

Staking is the process of locking up cryptocurrency as collateral to help validate transactions and maintain the security of a blockchain network, and in return, stakers receive rewards in the form of additional cryptocurrency.

Users that stake their ETH with Lido receive a tokenized representation of their staked ETH – called stETH – at a 1:1 ratio. StETH represents the user’s share of the total ETH being staked in the Ethereum network, and it can be freely traded on cryptocurrency exchanges.

One of the benefits of using Lido is that it allows users to earn rewards on their staked ETH without having to run their own staking node, which can be technically complex and require 32 ETH, which is out of reach for most cryptocurrency users. Instead, Lido pools user funds together to create a large validator node, with each user receiving a share of rewards based on their pool contribution. While Ethereum is by far the largest staking pool run by Lido, tokenized versions of other supported tokens are also available (stSOL for Solana, stDOT for Polkadot, etc.).

The Lido project is governed by a decentralized autonomous organization (DAO) that is controlled by LDO token holders, and LDO is used to incentivize participation in the governance process. Overall, Lido aims to make staking more accessible and user-friendly for the average cryptocurrency holder.

Why Lido DAO Token?

Lido developers have announced a new version of the staking protocol, dubbed “Lido V2”. The new version is expected to bring several improvements in the way the staking protocol works. Perhaps most importantly, the new update will allow users holding stETH to withdraw from Lido at a 1:1 ratio.

As a part of the Lido V2 upgrade, the team will be launching the Staking Router, a protocol upgrade “that moves the operator registry to a modular and more composable architecture.” In practice, the Staking Router will allow stakers, developers, and node operators to collaborate more seamlessly. The team believes this will boost the degree of Ethereum’s decentralization and make Lido a more secure and accessible staking platform.

11. Aptos

Aptos is a Layer 1 blockchain launched by a team of former Diem stablecoin engineers. After Meta’s inability to launch its own stablecoin solution, some members of the Diem team used their expertise and new technologies to establish Aptos.

While Aptos was first founded in 2019, it wasn’t until October 2022 that its mainnet went online, thus making Aptos one of the youngest projects on our list. Perhaps thanks to the high pedigree of the Aptos team or the community’s interest in the promised 100,000 TPS claim, the Aptos ecosystem quickly rose through the ranks and became one of the most popular blockchain solutions.

Thanks to its high transactional throughput, Aptos attracted a great deal of interest, primarily from NFT creators and collectors. However, several other decentralized applications found their way to Aptos as well, such as the PancakeSwap decentralized exchange (DEX), the largest dApp on Aptos in terms of TVL.

Why Aptos?

After a relatively slow start after its launch in 2022, the Aptos coin exploded in value this year, gaining more than +300% year-to-date. The price increase is mirrored in the number of user transactions, which have regularly been reaching or even surpassing 100,000 daily transactions, reaching a peak of 265,000 transactions on February 9th.

In addition to encouraging blockchain metrics, the Aptos Foundation recently hosted the Aptos World Tour event in Seoul, which saw more than 400 builders, 180 hackers, and 50 demo projects in attendance. This suggests that the Aptos community is quickly growing despite the project’s relatively nascent status.

Moreover, on February 17th, the Aptos team announced the Aptos Collective, an ambassador initiative aimed at supporting Aptos’ growth by providing members with exclusive perks, such as direct access to core Aptos team members, invitations to live events, career development and mentoring, and more.

According to our algorithmic Aptos price prediction, APT could experience considerable bullish activity in the next 3 months, reaching a new ATH above the $25 mark.

12. Uniswap

Uniswap is a decentralized exchange (DEX) that runs on the Ethereum blockchain. It was created in 2018 by Hayden Adams, and it allows users to trade various cryptocurrencies without the need for an intermediary or central authority.

Uniswap uses an automated market maker (AMM) system, which means that there is no order book or centralized exchange to match buyers and sellers. Instead, liquidity providers (LPs) contribute funds to liquidity pools, which are used to execute trades. Traders can swap one cryptocurrency for another by exchanging tokens with the liquidity pool, which uses a mathematical formula to determine the exchange rate.

The native cryptocurrency of the Uniswap platform is UNI, which is used for governance and for providing incentives to liquidity providers. UNI holders can participate in platform governance, including proposing and voting on changes to the protocol.

In the five years since its launch, Uniswap has grown to become the most popular decentralized exchange in the cryptocurrency ecosystem, with billions of dollars in trading volume and a large community of users and developers.

Why Uniswap?

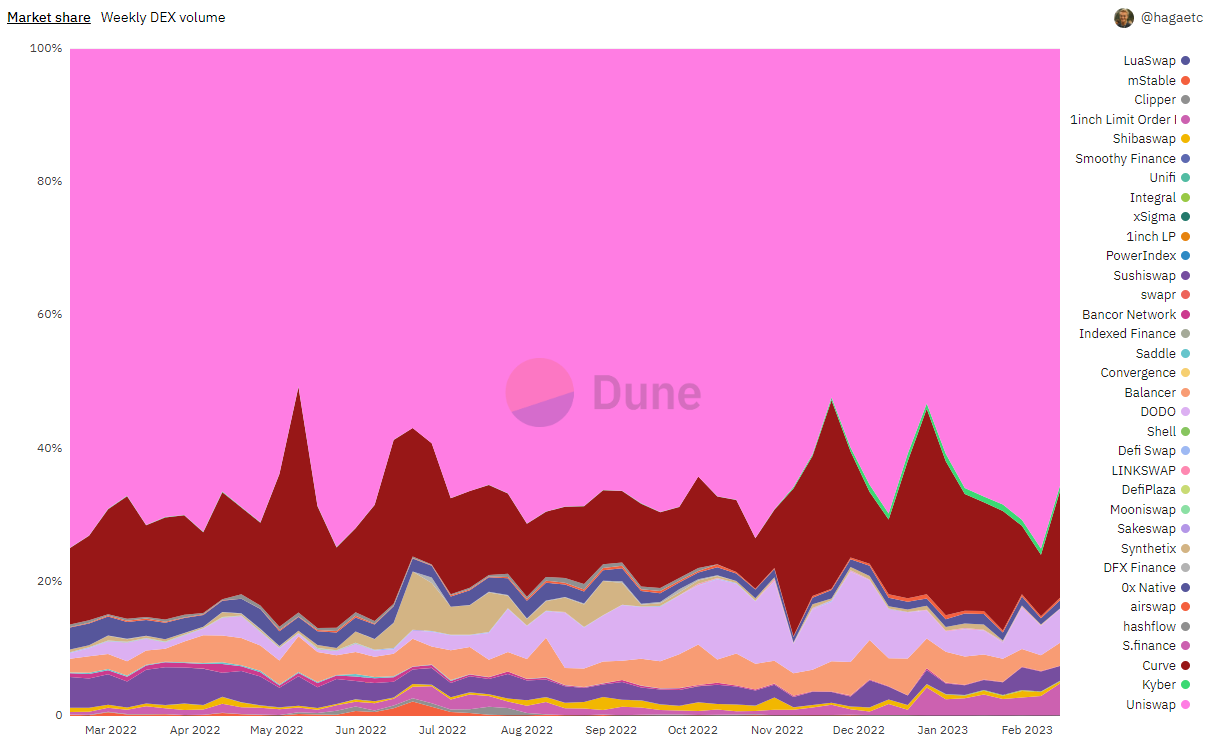

Despite dozens of options available in the crypto market, Uniswap has successfully retained its spot as the most active decentralized trading platform in 2022 and this year. According to Dune Analytics, the exchange accounts for more than 71% of all DEX market share. For comparison, second-placed Curve and third-placed 1inch trail with roughly 12% and 8%, respectively.

In addition to its DEX dominance, Uniswap has been expressing clear intentions to become one of the leaders in the NFT trading space as well. Last year, the company’s head of NFT products, Scott Lewis, said Uniswap wants to become “the interface for all NFT liquidity.” Users can access aggregated prices on hundreds of different NFT collections in the Uniswap app, providing them with a unique trading experience within a unified platform.

| Native Asset | Launched In | Description | Market Cap* | |

| Ethereum | ETH | 2015 | The leading DeFi and smart contract platform | $206 bln |

| Polygon | MATIC | 2017 | A popular scaling solution for Ethereum | $11.1 bln |

| Baby Doge Coin | BABYDOGE | 2021 | One of the most promising “meme coin” projects | $478 mln |

| Bitcoin | BTC | 2009 | The world’s oldest and largest crypto | $473 bln |

| BNB | BNB | 2017 | The native asset of the BNB Chain and Binance ecosystem | $51.4 bln |

| Cosmos | ATOM | 2019 | A leading interoperability-focused blockchain projects | $4.03 bln |

| TRON | TRX | 2018 | A popular dApp and decentralized storage network | $6.53 bln |

| Shiba Inu | SHIB | 2020 | NFT, DeFi, and blockchain gaming project | $7.55 bln |

| Maker | MKR | 2017 | A leading DeFi protocol featuring the Dai stablecoin | $748 mln |

| Lido | LDO | 2021 | The most popular liquid staking service | $861 mln |

| Aptos | APT | 2022 | A high performance Layer 1 blockchain | $2.11 bln |

| Uniswap | UNI | 2020 | The largest decentralized exchange in the crypto sector | $5.20 bln |

Best crypto to buy for beginners

If you are just starting out in crypto, it is advisable to stick to cryptocurrency projects that are less prone to volatility and are generally more established. While this approach does have a downside, as it becomes much more difficult to expect triple-digit or larger gains, the major upside is that you are not exposed to projects that have a chance of failing and thus losing your entire investment.

In order to identify projects that are stable and thus feature low volatility, you can start by following the parameters listed below:

- The crypto asset has a market capitalization that places it into the cryptocurrency top 100 (roughly $400 million as of early 2023)

- The crypto asset is available for trading on multiple trading platforms and can be exchanged for fiat currencies

- The crypto asset boasts healthy liquidity ($100M/day and more), which allows you to execute buy and sell orders quickly and without slippage

- The crypto asset is part of a reputable crypto project, with clear goals, a realistic roadmap, and products and services that look to address real-world problems

Some of the best cryptos to buy for beginners are those that follow the above criteria and have earned their standing in the crypto market due to robust security, popular products and services, and clear growth potential. Some beginner-friendly crypto investments are:

- Bitcoin

- Ethereum

- Litecoin

- Cardano

- BNB

It is worth noting that cryptocurrency investments are inherently risky, even if you stick to the biggest and most reputable projects. The reason for this is simple – the crypto sector is relatively new, and the landscape might look completely different in the future.

How we choose the best cryptocurrencies to buy

At CoinCheckup, we provide real-time prices for over 22,000 cryptocurrencies, with the list growing by dozens each day. As you can imagine, making a selection of a dozen top cryptocurrencies to buy out of such an immense dataset can be difficult and will for sure lead to some projects that should be featured being omitted. To minimize the chance of that happening, we follow certain guidelines when trying to identify the best cryptocurrencies to invest in.

Availability

One of the most important factors for any cryptocurrency investment is the crypto asset’s availability, meaning how easy it is to buy and sell it across various cryptocurrency exchanges. We tend to stay away from assets that are not available on major exchanges and require complex procedures to obtain.

Market Capitalization

Another important metric for identifying whether a crypto project is worth covering its market cap. A high market cap means that the project has reached a certain level of adoption from users, making it less risky to invest in.

Growth Potential

While this metric is mostly subjective, it is still an important metric on which we curate our selection. We won’t feature projects that we think are stagnating or have no real upside in the future.

The bottom line: What crypto to buy now?

The decision of which crypto to buy now is dependent on your own risk profile and investment goals. For some, investing in a crypto asset with a proven track record like Bitcoin is the only type of exposure to crypto they are willing to take on.

Meanwhile, those with a higher risk tolerance might see Bitcoin as too stable, looking instead toward newer and smaller projects that carry a higher degree of upside.

If you are looking for more investment ideas, check out our crypto price predictions section.

Andrew is a writer that does most of his work on cryptocurrency-related topics. While he’s primarily interested in Bitcoin, he also follows major altcoins and the innovative ideas that new cryptocurrency and blockchain projects are bringing to the table.

More Stories

U.S. Congressmen Seek Information Over Govt’s Crypto De-bank Efforts

Is It Worth Trading in Forex Markets in 2023?

Ethereum Outshines Bitcoin As Enthusiasm Grows